Ready to proof -- Clare 03/7/22

KJ proofed on 3/14 and sent corrections

Revised 3/14 - KJ sent more corrections on 3/15

Revised 3/15

Ready for author - sent back for final approval 3/22 - CLEAN

TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions, Nashville, TN

TiO2 Producers: Dealing with an Uncertain World

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

TiO2 buyers are dealing with a flurry of price increases through the first half of 2022. Most buyers are concerned with availability of supply. How long will this tight supply/demand scenario last? TiPMC is watching for leading indicators of the potential shift, primarily:

- Chinese net exports

- Chinese demand

- Chinese available capacity

- Chinese product acceptance

- Available feedstock for the Chinese industry

- Feedstock costs (chloride seeing increases more in 2022 as sulfate experienced through 2021)

- Chinese export pricing is still not competitive with their MNP counterparts.

- Continuous supply chain and logistics issues

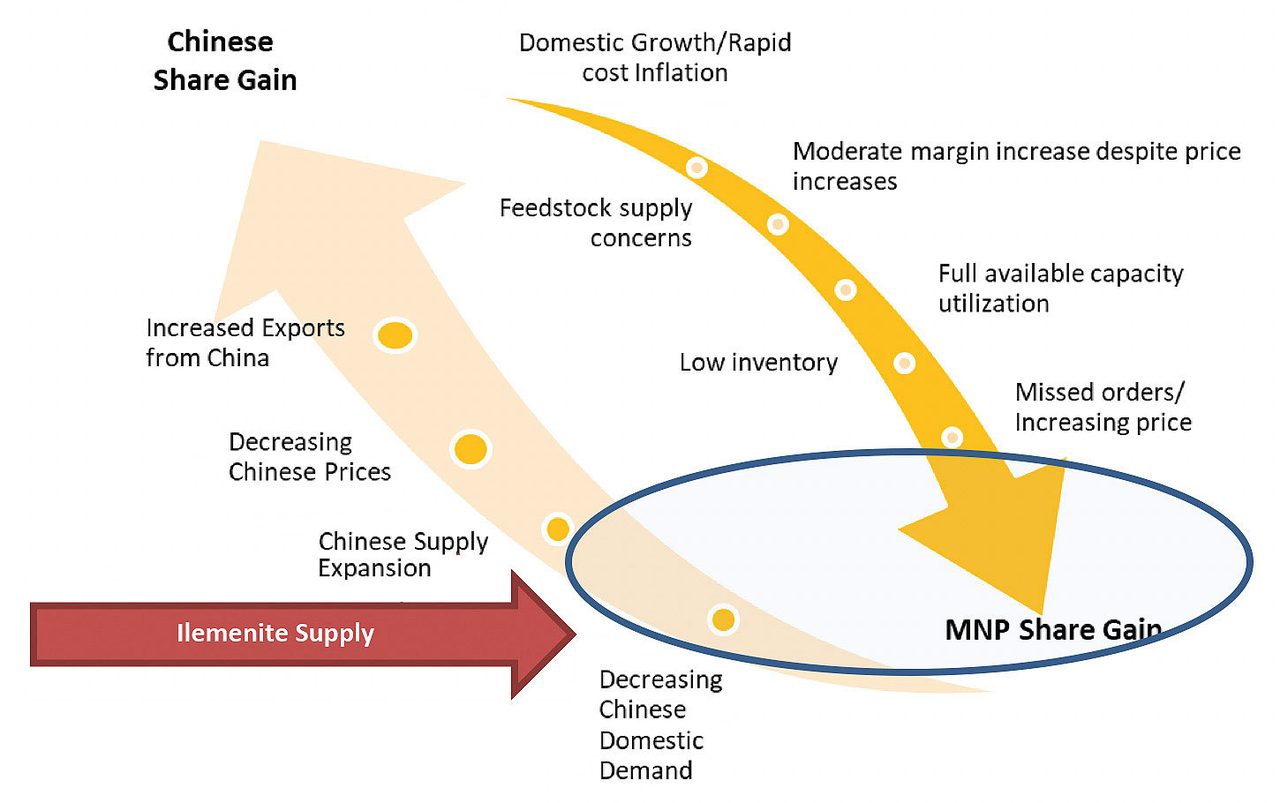

China has been responsible for the price cycles of the past decade. Market share shifts outside of China closely correlate to domestic demand and capacity utilization within the country. More production –> stagnant demand –> increasing exports –> oversupply outside China –> inventory build –> falling prices. Announcements of new capacity in China range in the 4-5 Mtpa range.

How should everyone view these announcements of increased capacity? Past results show only a fraction of what will become reality in the foreseeable future. This is particularly true now, as less than 20% of the announcements are sulfate capacity — the most common technology practiced within China. Given TiO2 is about a 7 Mtpa sales growing near GDP, there is still potential for significant impact.

Current conditions are leaning toward more difficulties to justify expansion. Steadily increasing costs, and feedstock availability are a major concern for Chinese producers. Chinese plants can expand, but will feedstock be available, and at what price? Depletion of sulfate ilmenite reserves, combined with a lack of new projects, present a major supply side concern. COVID-19 has slowed development of mining projects that were already financially and operationally challenging.

FIGURE 1 ǀ Chinese TiO2 dynamics impacting the global industry.

Source: TiPMC Consulting

Developed and Developing Markets

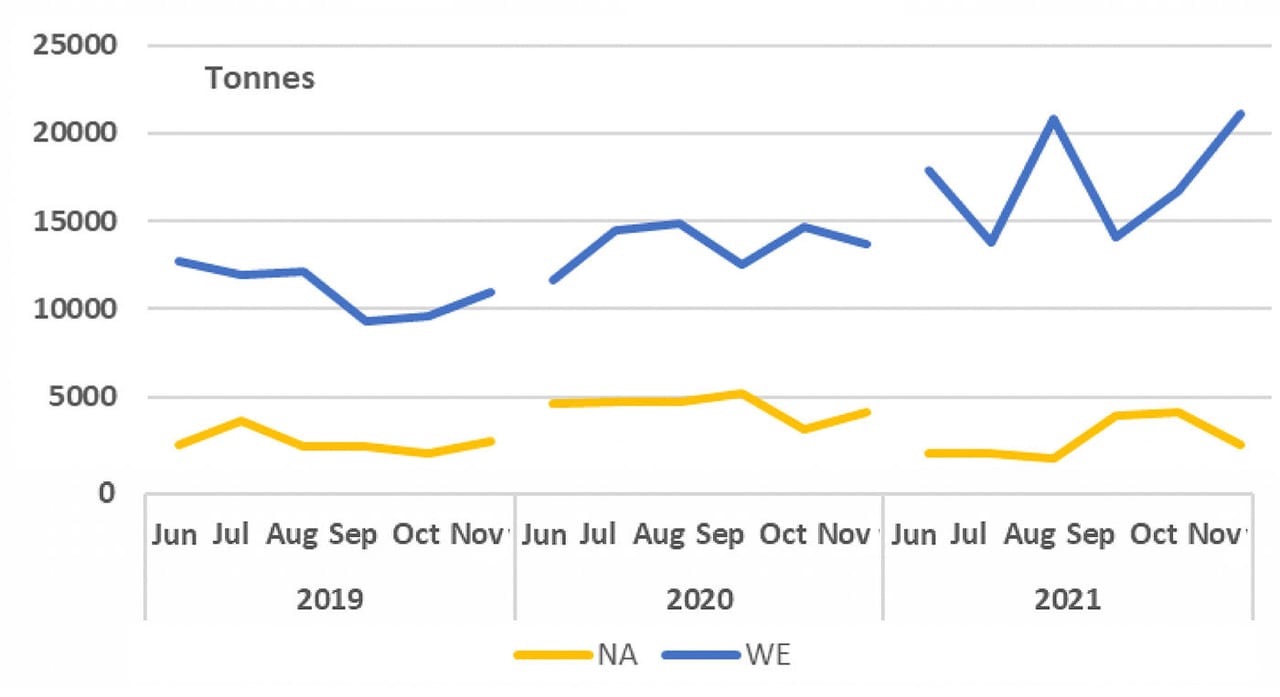

Another issue facing Chinese producers is product acceptance outside of their core markets. TiPMC has broken its view into developed and developing markets. In comparing 2021 and 2022, June through November exports increased about 23.5 kt to Western Europe. Conversely, shipments to North America dropped by 11 kt, netting an increase of 12.5 kt for the six-month period under review. Given the decrease in Western Europe of total imports, the increase is worth noting. Keeping in mind that Western European production decreased by 80 ktpa in 2021, the increase is more measured.

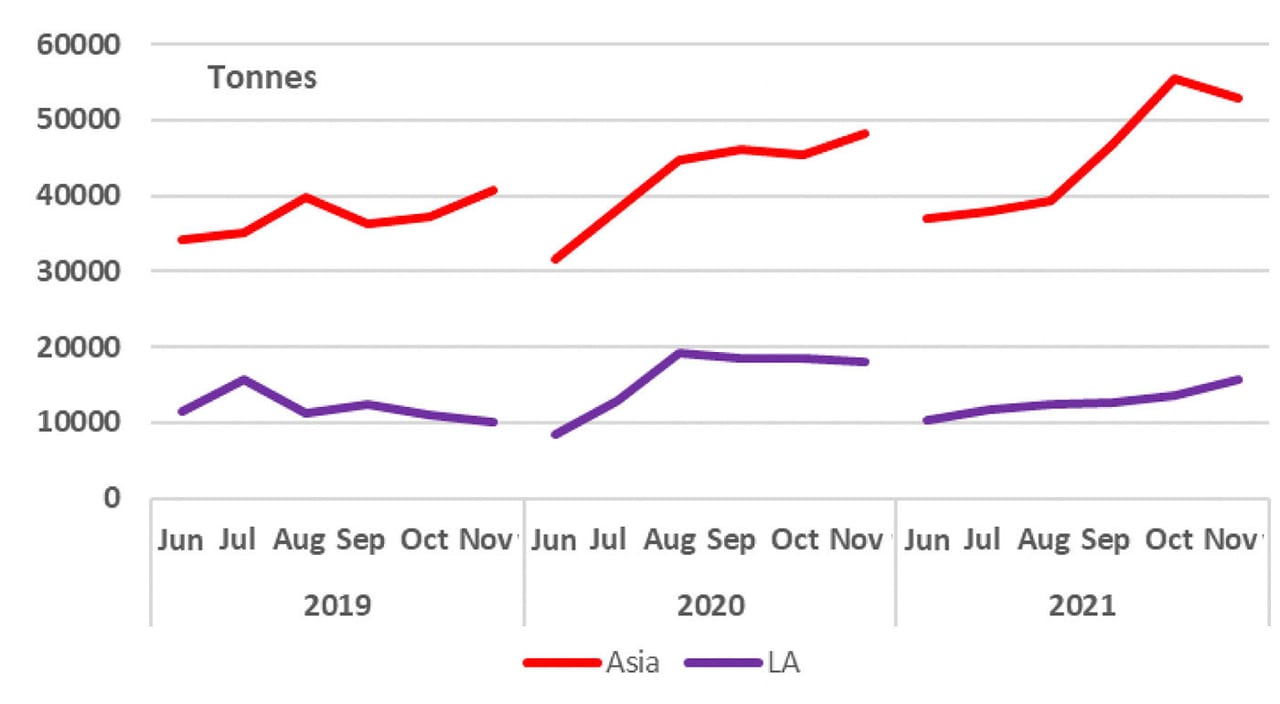

Latin America and Asia regions are where Chinese producers continue to hold the largest share. During the period being reviewed, Chinese exports to these two regions in sum are nearly equivalent. Exports increased about 15 kt to Asia, while decreasing 19 kt to LA. This is consistent with recent economic activity as APEC has continued strong economic growth, while Brazil, LA’s largest consumer of TiO2, has slipped into recession.

FIGURE 2 ǀ 2019-2021: Chinese exports into developed TiO2 markets.

Source: Global Trade Tracker

FIGURE 3 ǀ 2019-2021: Chinese exports into developing TiO2 markets.

Source: Global Trade Tracker

What Does it Mean for TiO2 Consumers?

The Chinese economy has slowed, and producers have resumed strong production rates since the energy-related rate reductions of October. Chinese exports increased in 4Q21 by 15% over the previous year. The ability to maintain this increased level of export is in doubt. The most recent lockdowns from a COVID-19 spike in Shenzhen and continued port congestion is making exports difficult. Inventories in China are reported to be low, and costs are escalating. The Chinese central government has announced policies to stabilize the economy, generally leading to increased construction activity and increased TiO2 consumption.

Even without a sharp increase in domestic demand, will Chinese producers be able to increase production with limited available feedstock and earnings? TiPMC believes new capacity will be more measured than in the past. Given this and other contributing factors, TiPMC believes tight supply and increasing prices will persist through 2022.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details. For more information about the impact price stabilization on the TiO2 industry, ask to see our latest issues.