Ready to proof -- CLJ 07/07/21

KJ sent a change on 7/15

CLJ revised on 7/15

Ready for author

TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions, Wilmington, DE

Impact of Price Stabilization Initiatives in 2021

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

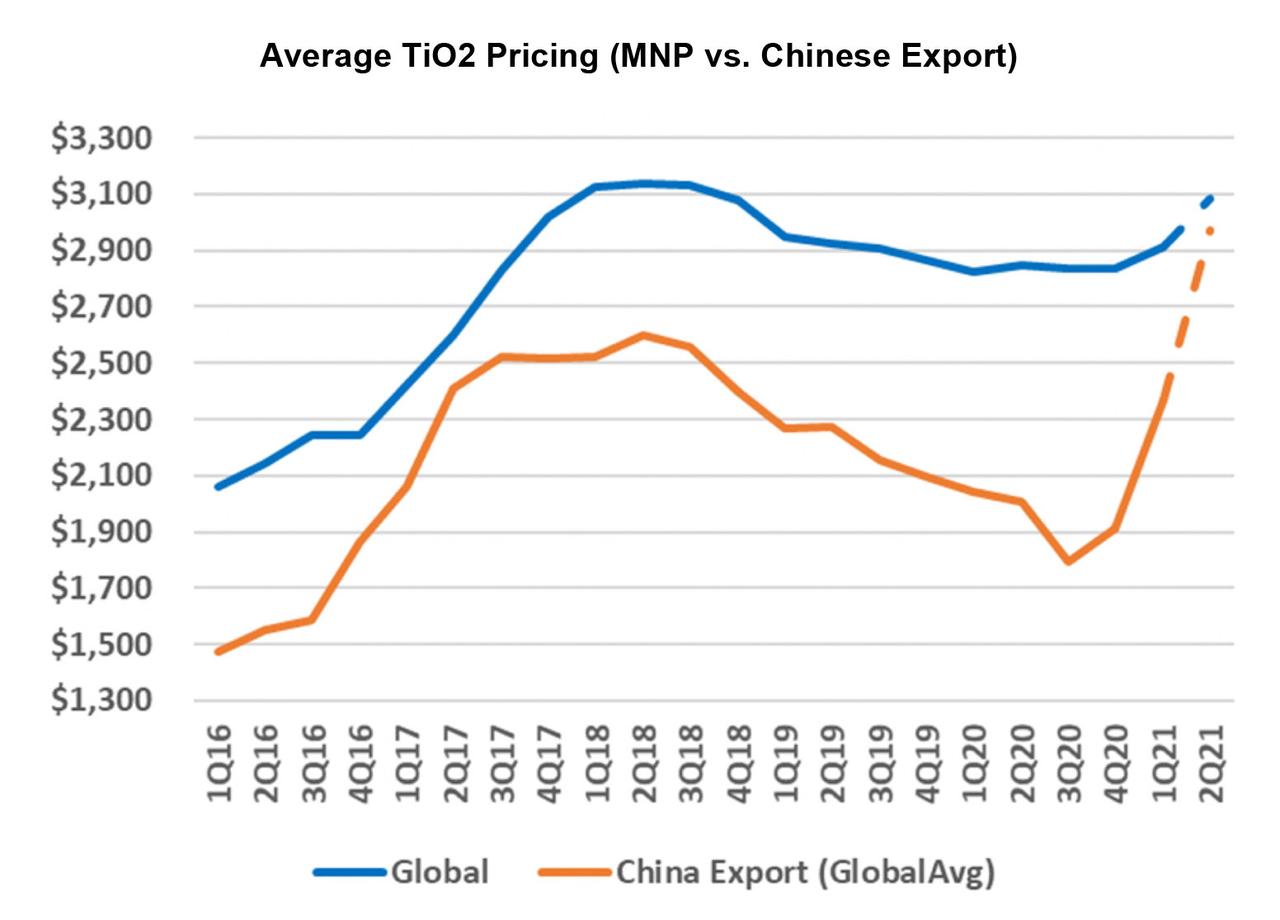

The TiO2 industry is in a position never before experienced in its long history as it moves through the seasonally high coatings demand period in North America. Demand is returning beyond average GDP levels, particularly in China. In turn, price-sensitive customers are absorbing a huge increase in price. TiPMC believes pricing stabilization initiatives, coupled with focus on segmentation by multinational producers (MNPs), has allowed them to reap the benefits foreseen in early 2021.

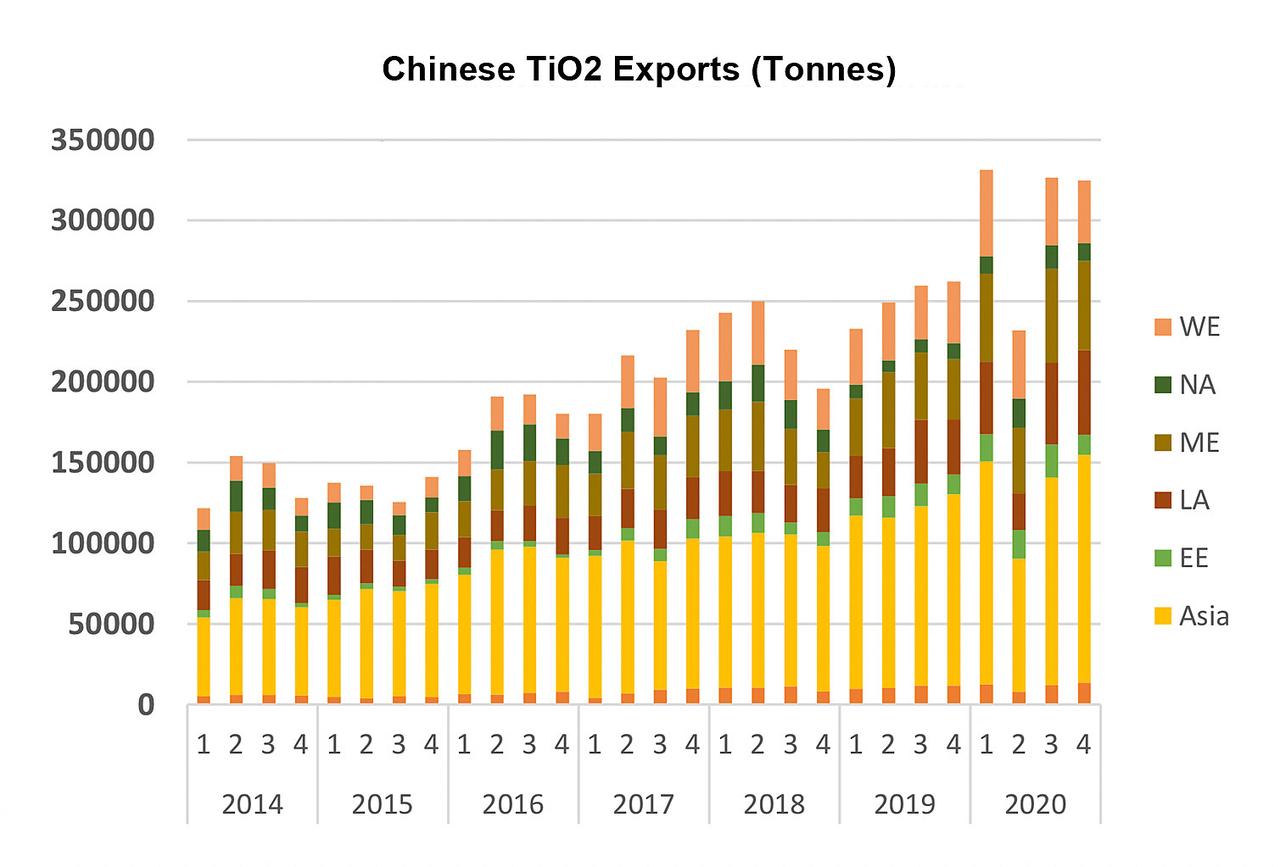

The pricing dynamic between MNPs and Chinese exports during the pandemic, along with the rapid increase in Chinese exports, provides insight into the current dynamic. As demand slipped in China, Chinese producers chose to gain export share through price reduction. Although volume was being lost, MNPs chose to hold pricing steady, anticipating a strong 2021 recovery. The strategy has paid dividends:

Chinese producers utilized their capacity for lower-priced pigment, removing incentive to consider expanding production.

Chinese costs are increasing such that margin expansion is not near the rate of price increases.

MNPs kept prices stable, enabling increases from a higher base than otherwise would have occurred. The net revenue impact is more favorable in the entire 2020-21 period.

MNPs did not deplete chloride feedstocks. Chloride feedstock prices are expected to be stable during 2021.

The only remaining capacity to meet global demand is with Chemours and Tronox. They are both utilizing the situation to gain longer-term volume commitments at elevated prices.

What Is the Likely Long-Term Scenario?

As noted in earlier articles, Chinese producers are announcing capacity increases. At some point, this capacity will be put into operation, serving price-sensitive buyers at lower prices than MNPs. What is the long-term plan for MNPs?

Although nothing is certain, it appears that MNPs may allow these customers to revert to Chinese suppliers vs. adding new capacity to support the 2021 share gains. MNPs will move their portfolios toward less price-sensitive customers via TiO2 supplier programs. These programs offer more price stability as incentive to customers seeking less variability in input costs. MNPs would then be able to grow their share with product development efforts vs. seeking lower-cost TiO2 sources.

MNPS are facing their own cost pressures. The rapid increases in chlorine prices, container and bulk freight, and energy in South Africa are already escalating variables for MNPs. Longer term, feedstock pricing will increase, as depletion and increased demand will impact chloride feedstock costs. Stability programs will need to enable passing these costs onto customers to satisfy the needs of shareholders.

The relative success of stabilization programs will ultimately be determined by customers. All customers will seek flexibility in maximizing supply chain tensions — price, supply reliability and consistent quality — to optimize their own needs.

TiO2 producers have changed the game, putting more pressure on buyers to execute their tasks in a much more sophisticated fashion than recent history.

FIGURE 1 ǀ 2016-2021: TiO2 pricing Iindex (pricing indexed to period average).

Source: Global Trade Tracker

FIGURE 2 ǀ 2014-2021: Chinese TiO2 exports.

Source: Global Trade Tracker

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue.