Ready to proof -- Clare 7/21/21

Proofed by KP 7/22/21

KJ proofed on 7/26

INDUSTRY UPDATES

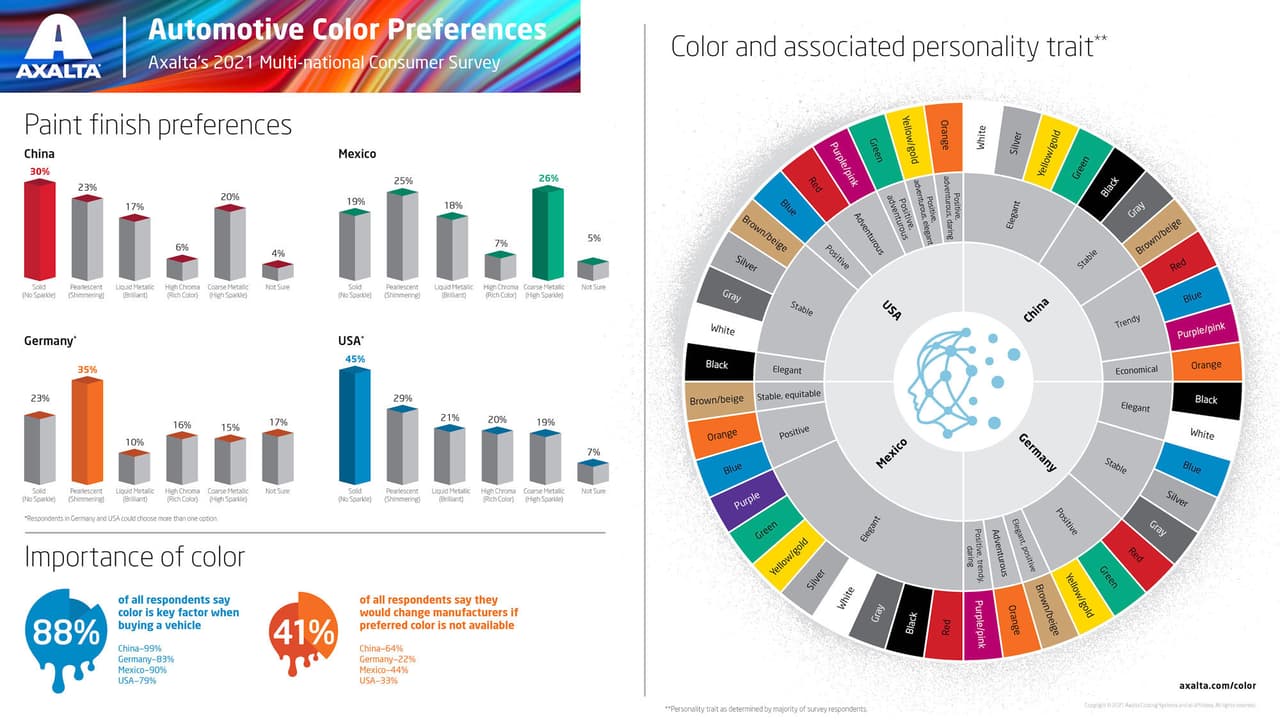

The survey analyzed the colors consumers wanted on their vehicles to understand potential future trends. While consumers may prefer or desire a variety of colors, individual preferences showed differences from country to country.

The survey also explored paint finish and paint effect preferences. High-gloss finishes were clearly preferred by all markets surveyed except for China. There, results showed a near-even split between high-gloss and matte finishes (48% high gloss vs. 52% matte). Paint effect preferences across the surveyed markets were not as similar as results for paint finish preferences. Solid effects were the top choice of respondents in the United States and China, whereas German respondents chose pearlescent, and Mexico chose coarse metallic and pearlescent as their preferred paint effects.

Axalta designs colors to meet the needs of automotive consumers around the world. The changing dynamics in color preferences between countries and vehicle types are studied to best forecast for future models. “The development of unique and new colors that meet the needs of our customers’ brands and consumer preferences is a key factor in understanding market trends. It is exciting to see how bolder colors are becoming more and more popular in the minds of consumers. Reds and blues are clearly rising in preference. It’s possible we’ll see more colors on the road with brilliant effects in the not too distant future,” said Lockhart.

For 68 years, Axalta has compiled and published the annual Color Popularity Report, the auto industry’s bellwether of car colors on the road based on original equipment manufacturer (OEM) sales. Axalta’s Consumer Automotive Color Preferences Survey builds on that color expertise, providing fresh perspectives and insights from automotive consumers on color and paint relevance.

Color is important for 99% of respondents in China when purchasing a vehicle. The preferred colors are white (29%) and black (26%). Red and blue ranked fifth and sixth. Of those surveyed, 64% would change manufacturers if they didn’t find their preferred color. Among these respondents, 93% are the sole decision-maker of the vehicle color purchased, while 7% rely on others to assist in the decision.

Of those surveyed in Germany, 83% said color is important when purchasing a vehicle. With 63% of respondents being the sole decision-maker about the vehicle’s color, 37% confer with family in the decision-making process. Black is the preferred color with 32%, while blue came in second with 16%. German participants consider black as a color that reflects elegance and blue reflects stability. In this region of the world, slightly more than one-quarter of survey respondents (27%) own a black compact vehicle.

For 90% of respondents in Mexico, color is a key factor when purchasing a vehicle. Red is the preferred color with 22% and is the top selection for both genders. Four out of 10 people surveyed in Mexico mentioned they would change manufacturers if they didn’t find the color for which they are looking. 64% of the participants reported owning sedan model cars. Red reflects an elegant personality and blue reflects positivity according to survey respondents in Mexico.

Color is an important factor when purchasing a vehicle for 79% of American respondents; nearly half of all respondents (46%) state color is very or extremely important. Of those surveyed, 82% of respondents in the United States say vehicle color is an individual decision, and 53% of households have more than one vehicle. Although black is an overall trend, truck owners are choosing more colorful versions of blue and red. Blue reflects positivity and red represents a sense of adventure in the minds of survey respondents in the United States.

PHILADELPHIA – Axalta recently released its Automotive Color Preferences 2021 Consumer Survey aimed at analyzing the relationship between color and vehicle purchasing decisions among consumers. More than 4,000 participants aged 25 to 60 in four of the largest vehicle-producing countries — China, Germany, Mexico and the United States — responded that color was a key factor in 88% of vehicle purchasing decisions.

“The psychology of color is a powerful influencing factor in automotive purchasing decisions. Frequently, color reflects the personality of the vehicle owner,” said Nancy Lockhart, Global Color Manager, Mobility Coatings at Axalta. “What’s interesting is that elegance, stability and positivity were predominant color characteristics desired by respondents surveyed.”

Survey Reveals Color Is a Key Factor in Vehicle Purchasing Decisions

Image courtesy of Axalta.

NACD Releases New Data on Severity of Ocean Shipping Crisis

ARLINGTON, VA – The National Association of Chemical Distributors (NACD) recently released new data on the severity of the maritime shipping crisis facing NACD members and shippers throughout the United States. The June 2021 survey, which follows similar research from March, shows that delays and costs associated with shipping have continued to rise dramatically over the last three months.

“This data is worse than we could have ever imagined and should concern every stakeholder in the U.S. supply chain,” said NACD President and CEO Eric R. Byer. “The state of shipping as it sits currently is not sustainable. Costs to consumers are already rising, and soon businesses will be forced to close their doors — if they have not already. Increased competition in ocean shipping and greater oversight and enforcement of rate increases are vital to remedying the situation. We welcome the Biden Administration’s focus on this critical issue and hope it will spur the Surface Transportation Board and the Federal Maritime Commission to enforce against excessive rates that we are currently seeing at historic levels.”

As previously reported, chemical inventories have been falling, with 84.5% of companies nationwide now reporting being out of stock of at least some imported products, up from 46.6% in March. An additional 7.1% of surveyed members reported being close to running out of stock, meaning nearly 92% will soon be suffering from shortages. With increased demand for shipping as the holiday season approaches, these shortages are likely to get worse before the year ends.

Delays in shipping have also continued to worsen, with 82.1% of respondents reporting average delays of more than 11 days, and the longest reported delay being in excess of 180 days. The survey found that the average length of the longest delay that respondents had experienced was nearly 61.5 days, 15 days longer than in March. Half of companies now report delays greater than two months.

According to the survey, the cost of shipping continues to rise despite the decline in reliability. Previously, 55% of respondents reported being charged additional premiums by carriers beyond tariffs and contract rates. In the current survey, 61 of the 84 respondents, or 72.6%, report paying these premiums.

John Dunham & Associates administered the survey in June 2021. A total of 84 responses were collected, meaning that the survey is significant within a range of +/-9.0 percent.

Photo: thitivong, iStock / Getty Images Plus / via Getty Images

CEO Alliance Backs EU Plan to Cut Carbon Emissions

AMSTERDAM – As the EU Commission prepares to present its Fit for 55 legislative package, the European CEO Alliance has issued policy recommendations supporting a progressive and ambitious push to achieve climate neutrality. Tackling climate change requires strong collaboration between the public sector and industry, the alliance announced after its meeting in Paris.

The alliance indicated that it would welcome a review of the EU’s major regulatory instruments, in particular subsidies for technologies with high CO2 emissions. The CEOs’ proposals include sending a strong carbon pricing signal by accelerating measures to decarbonize mobility and transport and buildings and energy systems, and speeding up the renewal of key industry sectors in the EU.

“I am very pleased to have been able to exchange views today with the companies that provide solutions for the implementation of the Green Deal, the decarbonization of the economy, green transition and energy efficiency. As the European Commission prepares to present its ‘Fit for 55’ energy and climate package with measures to reduce greenhouse gas emissions by 55% in 2030 and achieve carbon neutrality in 2050, the mobilization of industrial and economic players will be essential to achieving our climate objectives together,” said Clément Beaune, Secretary of State for European Affairs in the French government.

AkzoNobel CEO Thierry Vanlancker said, “Collaboration is key to fighting climate change, building economic resilience and ensuring that the EU Green Deal is a success. Through the European CEO Alliance, we’ll continue working together to accelerate the implementation of sustainable solutions and technologies within the buildings sector — one of several critical project areas. By transitioning towards carbon neutrality and helping to create more sustainable buildings, we can make a vital contribution and improve the places where we live and work. It’s not just about decarbonization, though. It’s also about health and well-being. As a company, we’re progressing well with ongoing efforts to cut our own carbon emissions in half by 2030. Today we can announce that we have accelerated and will have 100% renewable electricity in the EU already by 2022.”

As one central instrument, alliance members proposed a strong carbon price signal to achieve the EU’s climate targets, stating that carbon should have a price across the whole economy. The alliance also called for continued enhancement of the EU’s Emissions Trading System (for power and heavy industry) and for the implementation of sector-specific cap-and-trade systems that would apply to mobility, transport and the building sector. Sector-specific systems could then converge beginning in 2030. Another proposal concerns a European carbon pricing system that would include measures to simultaneously achieve a social balance and emissions reduction.

Turning its attention to the EU Commission’s Buildings Renovation Wave, the alliance supports ambitious renovation targets (of at least 3% p.a.) to accelerate the transformation of the building stock. Buildings should meet higher standards regarding energy efficiency, renewables and sustainable materials. The alliance also calls for fossil-fuel heating systems to be rapidly replaced by rolling out electric heat pumps, district heating and digital solutions. The CEOs are committed to applying this recommendation to their companies’ own buildings.

The European climate targets require a rapid build-up of renewable power generation and the direct electrification of mobility, transport and heating/air conditioning for buildings. The CEO Alliance is working on a project to integrate power systems, in particular grids, in order to create a system based mainly on renewables and flexible solutions.

The CEO Alliance for Europe's Recovery, Reform and Resilience was formed in 2020 against the backdrop of the COVID-19 pandemic and the historic European Green Deal. The alliance’s shared goal is to make the EU the world's leading region for climate protection while unlocking investments, fueling innovations in new technologies and creating future-proof jobs.

The members view themselves as an “action tank,” working together on cross-sector pan-European projects at scale: cross-EU charging infrastructure for heavy duty trucks, integration of EU power systems (in particular grids), digital carbon footprint tracking, sustainable and healthy buildings for the future of work and living, e-buses for Europe, green hydrogen value chains, and the rapid development of battery production. Further projects are being prepared, including one involving low-carbon steel. The CEOs will deliver their first tangible results and discuss implementation with high-level EU representatives at a summit set for autumn 2021.

The alliance brings together 12 top executives from the energy, transport and technology industries: Björn Rosengren (ABB), Thierry Vanlancker (AkzoNobel), Francesco Starace (ENEL), Leonhard Birnbaum (E.ON), Börje Ekholm (Ericsson), Henrik Henriksson (H2GreenSteel), Ignacio Galán (Iberdrola), Frans van Houten (Philips), Christian Klein (SAP), Christian Levin (Scania), Jean-Pascale Tricoire (Schneider Electric) and Herbert Diess (Volkswagen). McKinsey & Company is serving as a knowledge contributor for the CEO Alliance and is providing additional research and data.

Decarbonizing mobility, transport and buildings will be the major challenges. The alliance reports that for the transport and mobility sector, electric mobility for passenger cars, light vehicles and heavy-duty vehicles has proven to be the most efficient technology in terms of energy consumption and emission reduction. To foster the entire ecosystem around electric mobility, members of the CEO Alliance have initiated cross-sector projects to ramp up battery production and create a charging infrastructure across Europe.

The business leaders of the CEO Alliance met in Paris to discuss ways to further support the EU Green Deal. (Photo courtesy of AkzoNobel.)

Study Projects Steady Growth in Global Pigment Sales

LONDON – With urbanization at an unprecedented pace and construction activities reaching their peak, especially in developing economies across the globe, the global pigment is market is showing a steady growth outlook. A newly published market study by Fairfield Market Research suggests a stable 4.6% compound annual growth rate (CAGR) for pigment sales between 2021 and 2025. The report predicts the value of the global pigments market will reach around $40 billion by the end of 2025.

Demand for building and construction materials has increased over the past decade, due in part to governments supporting infrastructure development. The study reports that the increasing preference to use pigments for their functional attributes to safeguard paints from corrosion and extreme weather conditions is leading to increased pigment sales. Additionally, pigments provide aesthetics to painted surfaces, which is another factor that is driving consumption in modern construction and architectural projects. Sales of specialty pigments are also picking up in the building and interior sectors. The study also highlights soaring sales of high-performance pigments in the automotive and plastic industries.

Rising demand for commercial products such as 3D printing material and the booming digital printing industry are expected to provide a boost to market growth, according to the report. The shift in the printing industry towards environmentally responsible manufacturing practices and eco-friendly printing materials is fueling sales of organic pigments globally. The study found that printing inks currently account for nearly half of the market valuation of organic pigments. As the trend towards low- or zero-VOC compounds continues to expand, especially in paints and coatings and other allied chemical materials, organic pigment manufacturers will enjoy increasing demand in the future.

Photo: lunanaranja, iStock / Getty Images Plus / via Getty Images

According to the report, inorganic pigments also continue to witness steady sales, titanium dioxide (TiO2) and carbon black being the most sought-after products. The former holds over 65% of the value share in overall pigment sales, according to research. The report also suggests that a rising preference for packaged food consumption is benefiting pigment manufacturers in various ways. Another element in the economy that will likely drive pigment sales in the future is the thriving ecommerce industry. Packaging companies are generating substantial demand for pigments, thereby accelerating growth in the pigments market.

The study found that Asia-Pacific, one of the top manufacturers and consumers of pigments, is poised for an impressive 5.9% CAGR during the forecast period. While the region continues to deliver high production output, demand is particularly driven by the growing preference for decorative coatings. On the other side, the study reports that markets in North America and Europe have been witnessing a production downturn over the recent past, resulting in plant closures and restructuring.

Companies in the pigment industry are currently under pressure to move manufacturing bases and reduce their reliance on China, according to Fairfield Market Research. Strategic expansions and collaborations remain preferred moves of key companies in the global pigments market. However, high energy costs, the volatility of raw material prices and instability of supply remain major impediments to rapid market growth. Strict regulatory measures set by environmental and regulatory bodies are also playing out as a significant stumbling block. This, however, presents new opportunities for pigment manufacturers to explore organic, sustainable pigment production.

Supply chain disruptions and raw material issues due to the COVID-19 pandemic have compelled importers from around the globe to reduce their dependency on China. In addition to engaging in R&D initiatives for sustainable pigment production, companies are also investing in efforts to shift production bases to fast-developing Asian economies other than China.

Open Science Cloud Receives Partnership Status from European Commission

OXFORD, UK – In a €22 billion move to boost research and innovation investments, the EU Commission has awarded Europe’s Open Science Cloud (EOSC), alongside 10 other special European programs, European Partnership status to tackle societal challenges like climate change, sustainability and zero emissions on a large scale. EOSC will be granted special status as a co-programmed European Partnership. This new European Partnership status will provide a critical mass of funding, making it easier to improve the storing, sharing and reusing of research data across borders and scientific disciplines.

The EU Commission presented the EOSC Partnership during the EU Research and Innovation Days in June, and the memorandum of understanding with the newly formed EOSC Association will be signed shortly, bringing the total of new European Partnerships launched to 11. The EOSC Partnership Board also held its first meeting on June 25, 2021, officially putting the partnership into action.

European Partnerships — initiatives that bring the EU and private or public partners together to support research and innovation activities — have ambitious goals to overcome significant climate and sustainability challenges. The EC intends to make Europe the first climate-neutral economy, and EOSC can reportedly help deliver on the European Green Deal and support the digital transformation of science.

The partnership represents a new governance model for EOSC, placing stakeholders across Europe firmly in the driving seat. It will be an essential ingredient in changing the way research is carried out. Leveraging the EOSC Strategic Research and Innovation Agenda, the partnership has several key objectives to ensure that standards are defined, and services and tools are developed to enable researchers to find, access, reuse and combine results from all areas of research. As a result, open science practices and skills become the new normal and are rewarded and taught across Europe, and establish a sustainable and federated infrastructure enabling sharing of scientific results.

Commissioner Mariya Gabriel said, “The European Partnership for the EOSC will support all parts of Horizon Europe and enhance the possibilities for researchers to share information … My ambition is that Europe, through research and innovation, will become a world leader in the application of digital technologies in data-driven healthcare, connected and automated mobility systems, circular industrial production processes, and everything we call waste today is recycled, cleaner batteries, more affordable and reliable than today.”

Commissioner Thierry Breton said, “We can build on the huge R&I capacities, but we need all stakeholders of our industrial ecosystems to work together. The partnerships we are signing today are an important step towards achieving these objectives. They are essential to enabling synergies between the European Member States and private investments, and bringing together the ecosystems' different priorities and agendas. The global race on the technologies of the future is happening now. With these partnerships, Europe is coming at the forefront of global development.”

Working to improve research and innovation by making scientific discoveries findable, accessible, interoperable and reusable, the Open Science Cloud is set to remove the unnecessary duplication of results and costs involved in multiple organizations working on the same problems. Instead, by making research open access, these developments will lead to new insights and innovations, higher research productivity and improved reproducibility in science. EOSC intends to help European scientists reap the full benefits of data-driven science and give Europe a global lead in research data management. Key features of EOSC will be its smooth access to data and interoperable services and its trusted digital platform that addresses the whole research data cycle, from discovery, mining, storage, management, analysis and reuse.

President of the EOSC Association, Karel Luyben, said, “This partnership will pave the way for deepening Open Science practices in the new European Research Area and for contributing to the EU digital agenda. EOSC shall be seen as the research foundation of all sectoral Data Spaces defined in the European strategy for data. There is an enormous innovation potential arising from combining research data with public and private data.

“The EOSC partnership will promote best practices by the research communities and foster interdisciplinary research. It will trigger better connections between research infrastructures and e-infrastructures to leverage data services existing in Europe.”

Photo: PATCHARIN SAENLAKON, iStock / Getty Images Plus / via Getty Images