Ready to proof -- Niki 7/9/23

CB proofed 7/11 - one note for Niki on the photo credit

Revised Niki - 7/12/23

KJ proofed on 7/12. I left one note for Niki below regarding placement of our "Source" info with the tables and figures. Thanks.

The Architectural Coatings Market

Credit: asbe, E+, via Getty Images

By Atul Yadav, Assistant Manager, Market Research; and Dhiraj Kumar, Senior Research Analyst, MarketsandMarkets

The market for architectural coatings is projected to grow from $85.1 billion in 2023 to $102 billion by 2028, at a CAGR of 3.9%, during the forecast period. There is high demand for architectural coatings in the emerging markets of Asia Pacific due to the significant growth of the construction industry. Environmentally friendly characteristics, durability, and better aesthetic appearance drive consumption in various applications. Stringent and regulatory policies act as a restraint to the architectural coatings market. New construction activities, re-painting, and growing investment in emerging markets are the key factors providing market players with growth opportunities. However, the adoption of new technologies and volatility in titanium dioxide prices are the major challenges for market players.

Acrylic Resins Are Among the Largest Segment of Resins Used in Architectural Coatings

Acrylic resins are a group of associated thermoplastic or thermosetting plastic materials derived from acrylic acid, methacrylic acid, and other related compounds. Thermosetting acrylic resins are typically co-polymers of acrylic or methacrylate esters and a hydroxyl-functionalized acrylic ester. The hydroxyl-functionalized monomer provides a site for cross-linking. In thermoplastic resins, polymers containing the resin do not contain any reactive group, as polymer chains are not cross-linked.

Acrylic is the most widely used resin due to its strength, stiffness, excellent solvent resistance, flexibility, impact resistance, and hardness. It improves surface properties such as appearance, adhesion, and wetting, and provides resistance to corrosion and scratching. The coating process involves the application of paints and coatings to a substrate of one or more layers of functional materials in the form of liquids, gases, or solids.

TABLE 1 ǀ The acrylic resins segment accounts for one-fourth of the architectural coatings market globally.

Source: Secondary research, interviews with experts, and MarketsandMarkets analysis.

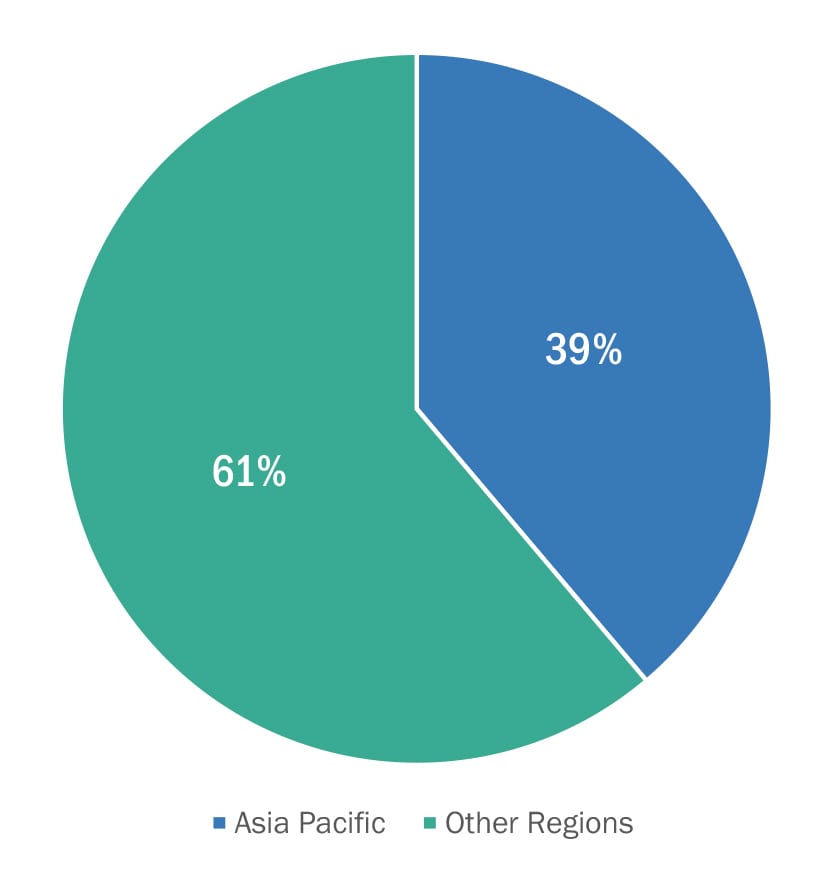

China and India are Leading the Growth of Architectural Coatings Markets Globally

The Asia Pacific market is witnessing high growth and is expected to continue because of the increasing residential construction and improved home remodeling practices. The Asia Pacific region encompasses a diverse range of economies with different levels of economic development and multiple industries. Development is mainly attributed to the high economic growth rate, followed by heavy investments across the automotive, consumer goods and appliances, building and construction, and furniture industries. The key leading players are expanding their architectural coatings production in Asia, especially in China and India.

For instance, global companies are shifting their production bases, establishing sales offices, and enhancing distribution channels to regions including Asia Pacific, offering sustained demand. The gradual shift of production facilities to Asian countries with high demand and lower production costs positively influences market growth. The leading producers control a major share of the global market. As a result, there is high competitive pressure on architectural coating producers to reduce the prices of architectural coatings to gain market share at the expense of other competitors. Regulatory standards regarding the usage of solvents and VOC emissions are crucial parameters to be considered by architectural coating suppliers.

FIGURE 1 ǀ Asia Pacific, the most prominent architectural coatings market in 2022.

Source: Secondary research, interviews with experts, and MarketsandMarkets analysis.

Environmental Regulations and the Shift Toward Waterborne Technology are Driving the Market

The increasing demand for eco-friendly features has been one of the most vital trends observed in the coatings industry in the past decade, influenced mainly by stringent EU regulations regarding reducing VOC emissions in the coating life cycle. This has shifted the demand from solventborne coatings to eco-friendly products such as waterborne and powder-based paint and coatings.

New rules and strict regulations, such as the Eco-product Certification Scheme (ECS), are set by the European Commission and other federal government agencies. These regulations ensure a green and sustainable environment with minimum or zero harmful VOC emissions. Also, the regulations on lead control in household and architectural coatings were implemented in 2016 after the Quality Council of India (QCI), Pollution Control Board Authorities, and the National Referral Centre for Lead Projects in India (NRCLPI) strongly recommended the Government of India (GOI) to fix lead content below 90 ppm for all architectural and household paints. These regulations encourage manufacturers to invest in bio-based raw materials for paint and coatings, making architectural coatings eco-friendlier. In addition, government regulations in the United States and Western Europe, especially concerning air pollution, will continue to drive the adoption of new, low-polluting coating technologies.

Architectural coatings have gained popularity over the past few years as a VOC-free and lead-free technology. In mature economies such as Western Europe and the United States, the need to manufacture eco-friendly architectural coatings is increasing in industrial, residential, and non-residential construction sectors due to the rising awareness of the benefits of these paints. In addition, architectural coating companies play a crucial role in making the environment greener by launching premium products, which also adds to profitability. Such initiatives will help architectural coating companies to achieve sustainable growth in the near future. Thus, the awareness of eco-friendly paints and regulations leads to new materials, new formulations, and the advancement of equipment and application processes, driving the demand for architectural coatings.

Future Trends and Disruptions Impacting Market Growth

The architectural coating market is a highly competitive and dynamic industry experiencing significant changes in recent years. The changes have been led by various factors, including changing consumer preferences, technological advancements, and regulatory pressures. Companies that can alter to these changes and innovate their products and processes are expected to succeed in this dynamic and competitive market.

FIGURE 2 ǀ Future trends and disruptions are expected to impact the architectural coatings market.

Source: Markets and Markets analysis.

The trends and disruptions mentioned in the figure are a few factors expected to impact the industry in the coming years. Companies that stay informed and proactive in responding to these changes are expected to be well positioned to succeed in the exciting and ever-evolving market.

For more information about the full report, click here.