Ready to proof -- Clare 11/14/22

CB proofed - clean on my end

KJ proofed on 11/16 - need to add link to advertisement once it is added in the issue

TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions

European Energy Costs and Chinese Lockdowns Dramatically Impact TiO2 Demand

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

The TiO2 industry is entering a significantly challenging time. The optimism of the first half of 2022 has completely turned in the opposite direction. European demand may be off as much as 40-50% in the second half of 2022 versus the prior year. Although China is much more opaque, operating rates and pricing developments point to reduced demand perhaps in the double-digit range versus prior year comparisons. Numerous operating plants are reported to be curtailing or ceasing production. North America and Latin America were reported to remain strong. These regions are expected to slow in 2023, as recession is likely.

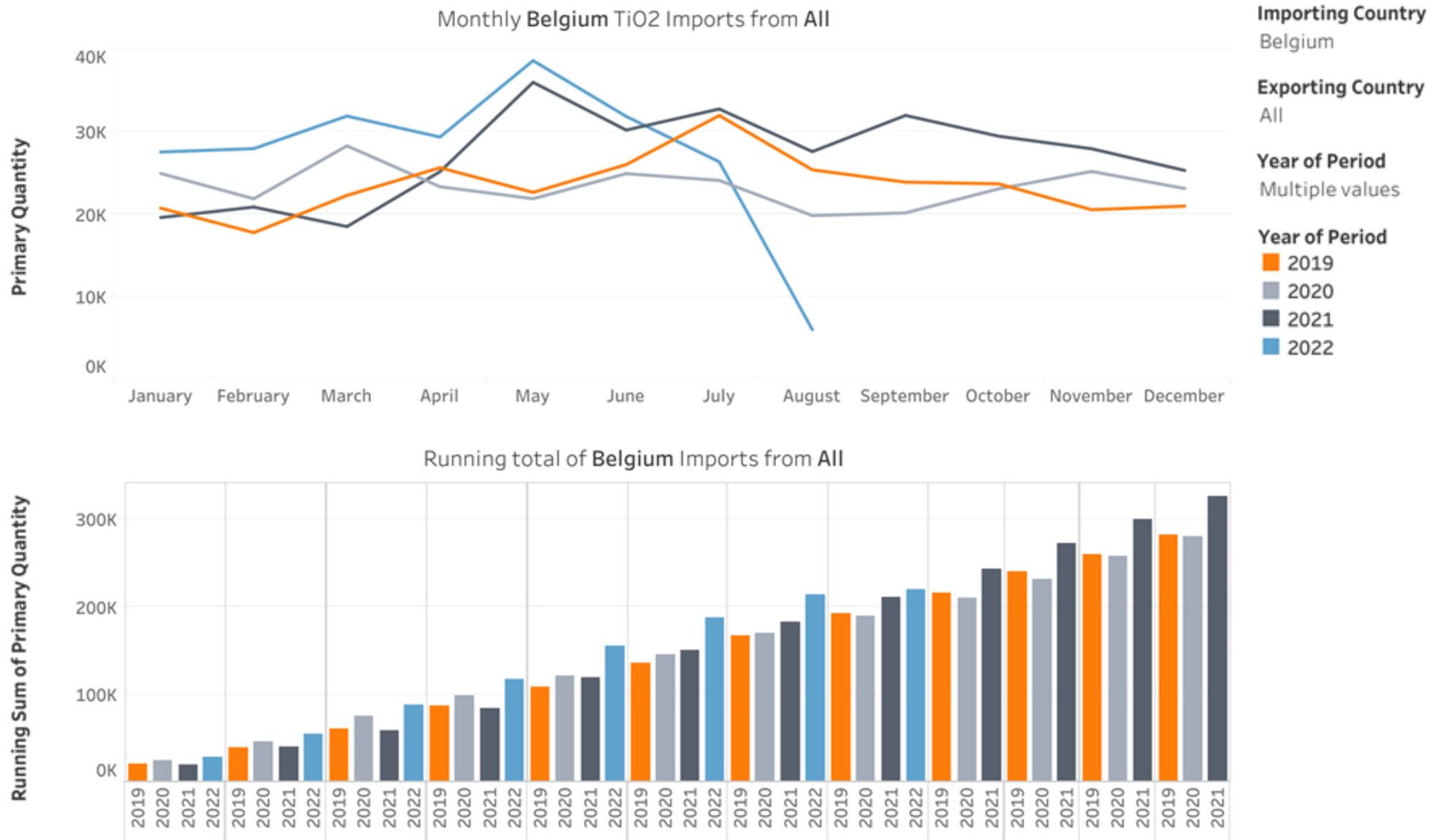

Demand in Europe dropped dramatically as energy prices spiked, reducing disposable income. Multiple reports are also indicating large-scale destocking on the part of TiO2 consumers. These forces combined for a dramatic impact. Imports into Belgium, a major hub for distribution throughout Europe, fell dramatically in August.

FIGURE 1 ǀ 2019-2022: TiO2 import volumes into Belgium.1

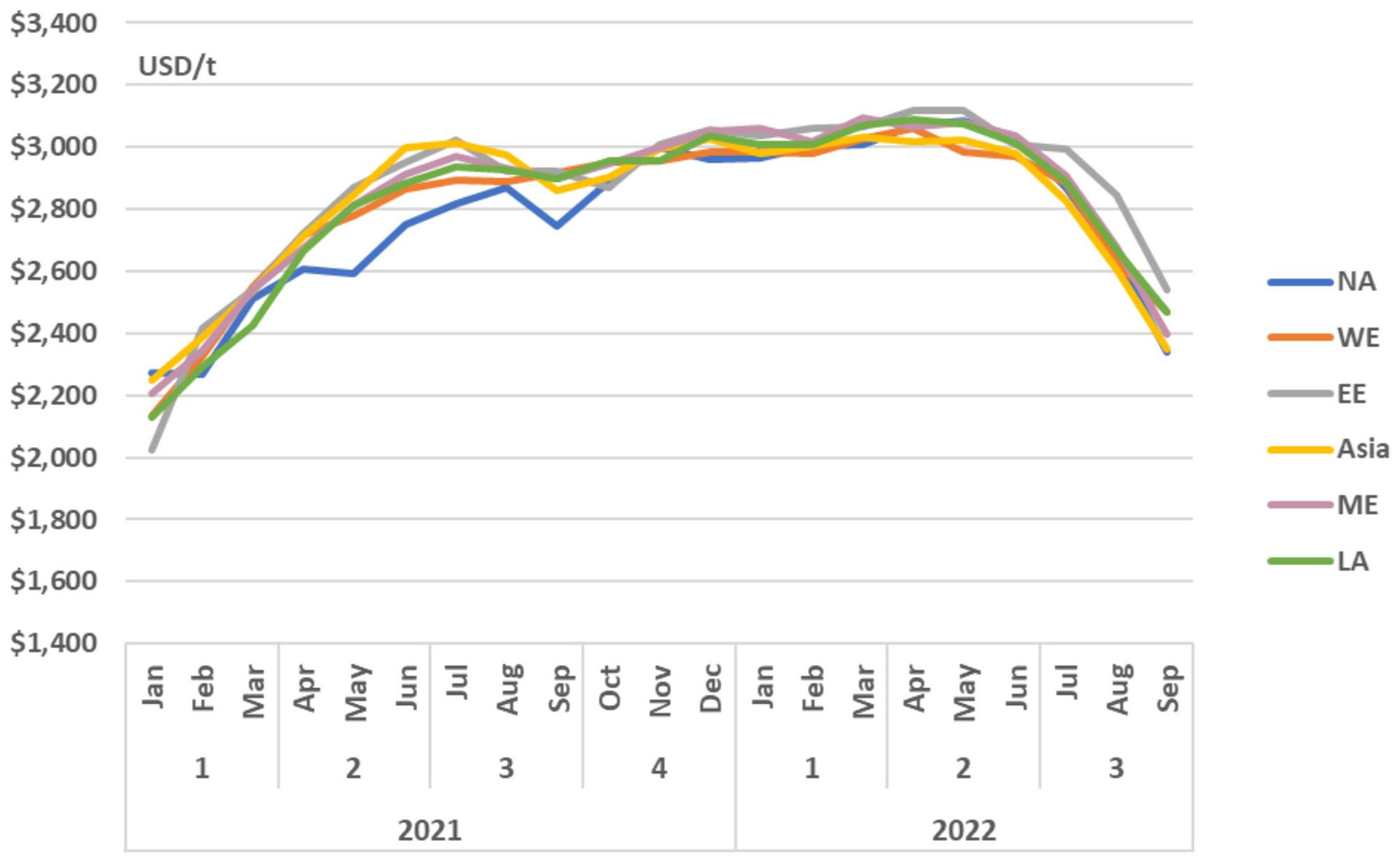

Chinese producers are feeling the impact of weak domestic demand. Chinese pigment prices dropped dramatically, beginning in August. Early fall is generally considered the Chinese “Golden Season” for Chinese producers. Reduced raw material costs, such as sulfuric acid and domestic TiO2 feedstock, combined with softening export demand, led to significant export price decreases. Many observers believe current prices are below the costs of multiple producers and are unsustainable.

FIGURE 2 ǀ 2021-2022: Chinese export prices to global regions.2

Multi-National Producers (MNPs) have responded with dramatic cuts in production. TiPMC estimates nearly 400ktpa of TiO2 capacity in Germany has been reduced to minimal operating levels during 4Q22. Tronox announced volumes will be down 25-30% sequentially in 4Q22, following a 13% sequential drop in 3Q22. Chemours noted extending a scheduled outage on a large production line, defining the volume impact more than seasonal norms in 4Q22. These actions will maintain manageable inventory levels while the industry deals with dramatically reduced demand.

What Does it Mean for TiO2 Consumers, and What Can be Expected in the Future?

TiPMC believes MNPs will carefully manage sales volumes and inventories to minimize the impact on TiO2 pricing. This is consistent with their actions during the previous cycle, as price stabilization initiatives are expected to continue through the current downturn.

Chinese producers have responded with significant price reductions to maximize volumes, consistent with their actions during previous cycles. Next year, 2023, will prove challenging for all TiO2 producers. Europe remains highly uncertain. TiPMC believes MNPs will maintain a strict focus on cash flow. Input costs are expected to see little relief, particularly for chloride producers in North America. Chinese producers remain focused on growth and expansion despite significantly reduced margins. The current situation is highly unprecedented.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com, or see our ad in this issue for more details. For more information about the impact price stabilization on the TiO2 industry, ask to see our latest issues.

1 Global Trade Tracker / Tableau® for TiO2.

2 Global Trade Tracker.