Ready to proof -- Clare 12/10/21

KJ proofed and sent corrections on 12/13.

Revised 12/1

Ready for author

TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions, Wilmington, DE

TiO2 Producers: Opportunities and Challenges Vary

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

The TiO2 industry is seeing favorable supply and demand conditions. Chinese producers, the usual industry disruptors, are facing far more serious challenges than their multi-national competitors. For now, the tables appear to be turned.

The disruptions for the Chinese come from multiple sources:

- The Chinese energy crisis is impacting TiO2 producers in terms of costs, but more in terms of their ability to operate. TiPMC expects Chinese production to be reduced by 40-50 ktpa, or about 15% of available capacity.

- Coupled with environmental and energy restrictions on energy, the Chinese housing bubble is decreasing TiO2 demand. As China is primarily domestically supplied, this is impacting domestic producers.

- Chinese export pricing is still not competitive with their multi-national counterparts.

- Freight costs, both outbound and inbound, are increasing Chinese producer costs.

- Feedstocks going into China are still very tight. Domestic production is equivalent to 2020, and port inventories are low.

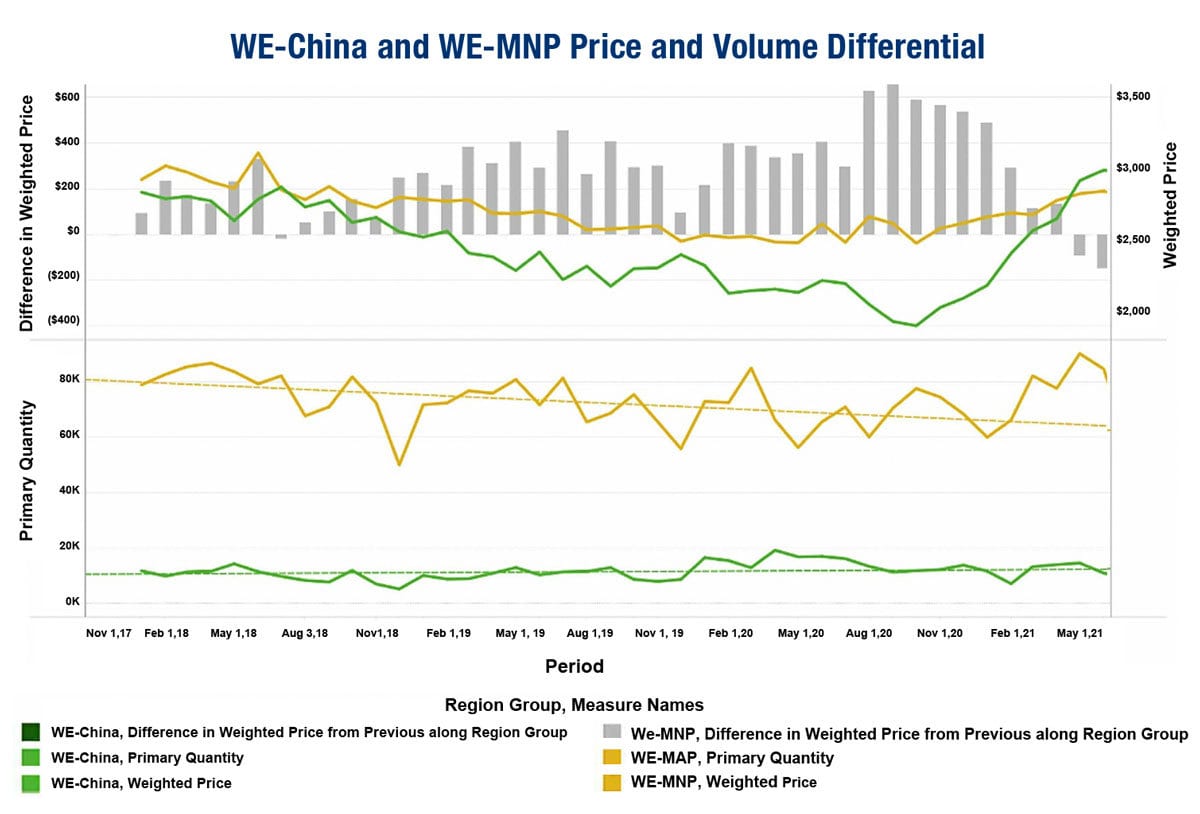

FIGURE 1 ǀ TiO2 import pricing and volumes to Western Europe. Note: Data in later months skewed by countries yet to report. Source: Global Trade Tracker.

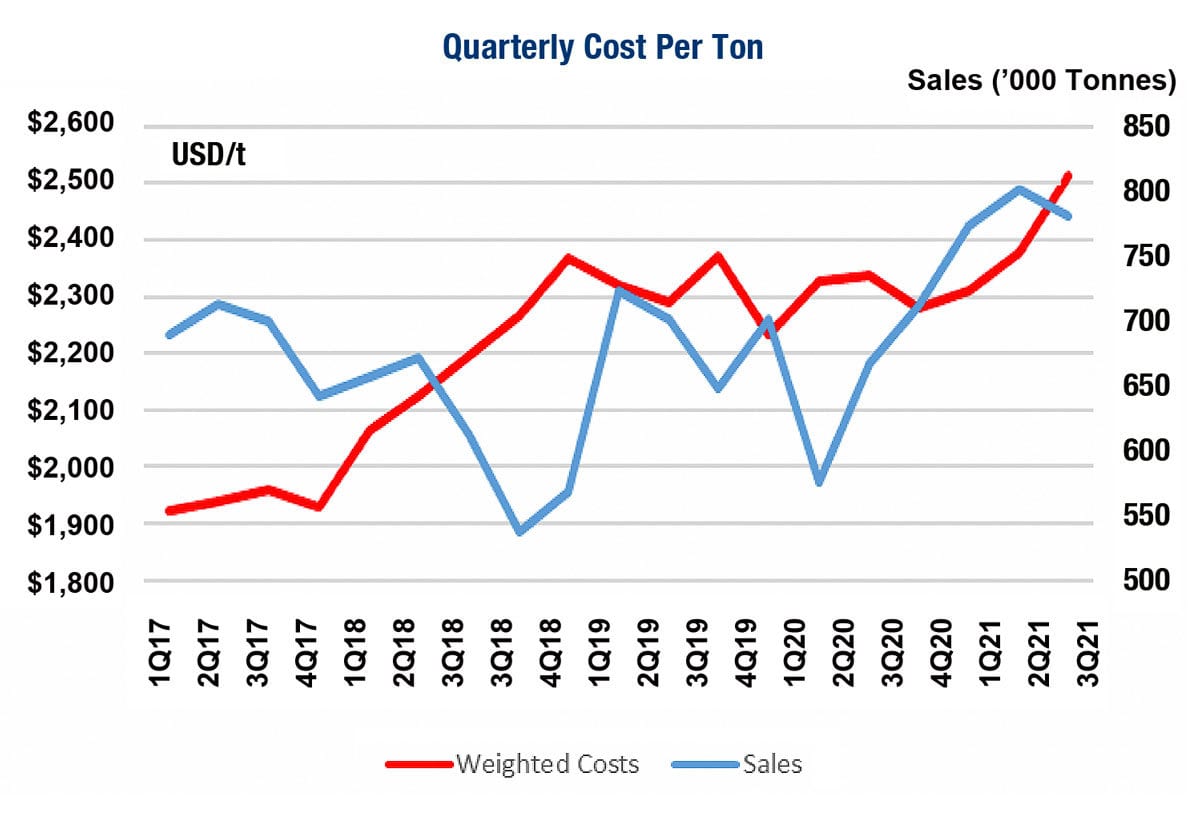

FIGURE 2 ǀ 2017-2021: Costs and sales of four leading multi-national producers (MNPs). Source: Company 10Qs/TiPMC Estimates.

What is the result? MNPs are gaining share, and prices are increasing from all producers. Utilization rates are increasing among all producers, within and outside China.

The situation is not ideal for MNPs. Supply chain pressures are impacting costs for all producers. Chlorine availability and costs are severely impacting U.S.-based TiO2 producers. Chloride feedstocks are in very short supply, due to disruptions to supply in South Africa and continuing depletion of chloride resources. COVID-19 travel restrictions and competition for financing vs. other mining industries are hampering new projects to supply increased demand and off-set depletion.

What Does it Mean for Coatings Producers?

Unlike other raw materials, TiO2 is available for coatings producers. Given the extreme tightness, prices have increased, but not near the escalation of 2011 and 2012, given the similarities in cycle dynamics.

TiPMC believes that value and margins stabilization programs are highly responsible for the current dynamics. MNPs do not wish to create the incentive for Chinese producers to accelerate capacity expansions, creating restocking and downward pricing as demand cools. TiPMC does foresee continuous increases through 2022, with market conditions stabilizing, and Chinese expansion, despite re-investment economics, leading to further cycles. However, TiPMC believes these cycles will be less severe and the overall pricing trendline to continue upward. This will be required to offset cost inflation and support expansion of quality assets.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com. See our ad in this issue for more details. For more information about the impact price stabilization on the TiO2 industry, ask to see our latest issues.