Ready to proof -- 5/23/22

KP proofed 5-23-22

KJ proofed on 5/24 - sent changes to Clare

Revised on 5/24

INDUSTRY UPDATES

“Being awarded a Royal Warrant of Appointment in 2011 marked one of the proudest moments in our 247-year history,” said Group Chairman Abubaker Sheibani. “We are one of fewer than 800 specialists-in-their-field globally to achieve this prestigious and rare accolade. So we are thrilled to have been able to extend this Royal connection to this unique project. It is a fitting and truly memorable way of commemorating Her Majesty becoming the first British Monarch in history to reign for 70 years.”

The train was repainted in T&W Williamson’s Spec 81 paint, Purple SP01353, to match the official color of the platinum jubilee, and its Spec 81 Undercoat Madder. Taw Valley — named after a river in Devon — was built in 1946 and operated in Ramsgate, Brighton and Salisbury before being withdrawn from service in 1964. It was later rescued from a scrapyard in Wales by Bert Hitchen, the former road cycling champion from Mirfield in West Yorkshire, U.K., who became increasingly involved in railway preservation after leaving the sport. Its restoration began at the North Yorkshire Moors Railway before entering service at Severn Valley Railway in 1988. The name change and repaint will only be a temporary measure — later this year the locomotive will be restored to its original name and green livery.

“This is all about making the biggest impact possible,” said Severn Valley Railway Chairman Mike Ball. “We’re putting a huge amount of effort into our celebrations for both The Queen’s Platinum Jubilee and the 2022 Commonwealth Games, which are being held in Birmingham. We’re sure that the unusual appearance of the loco will prove a huge draw to visitors.”

T&R Williamson, founded in 1775 and believed to be the oldest family operated paint manufacturer still in existence worldwide, is part of the privately run Sheibani Group. The group’s growing portfolio of U.K. businesses also includes Midlands-headquartered Thomas Howse Paints, which was established in 1903, and the Leeds-based Metprint Ltd., a metal packaging specialist.

RIPON, England – Historic paint specialist T&R Williamson, whose products are used across the British Royal Household, is ensuring a landmark project to mark the Queen’s platinum jubilee goes full steam ahead in a unique way. The company, which holds the prestigious Royal Warrant, has played a key role in transforming one of the country’s most popular steam locomotives into “Platinum Purple.”

Along with its eye-catching new livery, the Taw Valley locomotive will be renamed Elizabeth II following a public vote carried out by its custodians Severn Valley Railway, which operates a 16-mile heritage line in Shropshire and Worcestershire in the U.K.

This Royal repaint is the latest in a long line of flagship heritage projects where restoration experts have turned to Ripon, England-based T&R Williamson’s specialist paints and protective coatings to help bring them to life. These include Stephenson’s Rocket, The Flying Scotsman, The Orient Express, The Royal Opera House, Golden Gate Bridge, as well as The Royal Mews and Royal Carriages.

UK Paint Specialist Transforms Steam Locomotive to Herald Queen’s Jubilee

Image courtesy of T&R Williamson.

New York State Launches Paint Recycling Program

ALBANY, NY – A new paint recycling program in New York State invites households, schools and businesses to recycle leftover paint, stain and varnish conveniently and sustainably. The program is operated by PaintCare, a nonprofit organization created by the paint industry through the American Coatings Association (ACA) to manage leftover paint in states that have enacted paint stewardship laws. PaintCare plans to expand to over 300 drop-off sites across New York State in the coming months through partnerships with paint retail stores and local government facilities. New York’s paint recycling program comes in the wake of a paint stewardship law that was passed by the State Legislature in 2019.

“We’re excited to launch our paint stewardship program in New York State so that households, businesses and institutions can drop off leftover paint at their convenience, all year long,” said Andrew Radin, PaintCare’s New York Program Manager. “We’re grateful for the important role that paint and hardware stores, as well as local government facilities, will play in making sure this environmental initiative is successful by voluntarily serving as drop-off sites. We look forward to adding additional partners in the coming months as we aim to recover and recycle over one million gallons of leftover paint each year.”

The new program is expected to manage more than 1.1 million gallons of paint in its first year. In New York, 36.6 million gallons of paint are sold annually, and it is estimated that about 10% of household paint goes unused. PaintCare helps ensure the “highest, best use” for paint collected in the program, including giving away good quality material as-is, recycling it or putting it to another beneficial use. Most of the paint PaintCare receives is latex based and can be remixed into recycled content paint by processors.

Image courtesy of the Product Stewardship Institute.

Sales of Top 50 U.S. Chemical Producers up 35% from Previous Year

WASHINGTON – As the economy continues to recover from the COVID-19 pandemic — and despite rising costs — the chemical industry in the U.S. is experiencing a strong rebound, with most of the top companies reporting increased sales and profits. That’s according to Chemical & Engineering News, an independent news outlet of the American Chemical Society, which has published its latest survey of the top 50 U.S. chemical producers based on the 2021 fiscal year.

The survey reveals a sharp rise in sales and profits for chemical producers, writes Senior Correspondent Alex Tullo. Combined, the top 50 companies posted $333.6 billion in chemical sales in 2021, up 34.9% from the previous year. Only a few firms saw sales declines (Ashland, DuPont and Ecovyst), because they recently sold major businesses. All other firms reported sales increases. A large portion of the increase in revenues is from the rising costs that were passed on to consumers as supply chains and sourcing chemical feedstocks continued to be issues in the industry. To keep up with these costs, most companies increased their chemical capital spending and R&D budgets, in contrast to the drastic spending cuts made during 2020 lockdowns.

Photo credit: Maxiphoto, E+, via Getty Images

Even in the face of rising costs and increased spending, the combined operating profits of the top 45 firms totaled $56.0 billion, an increase of 129.8% compared to 2020. Dow, the top chemical producer according to the survey, reported a profit increase of over 200% and $55.0 billion in chemical sales. Planning for the future, a few of the largest chemical companies, including Dow, ExxonMobil and Air Products, have invested in carbon capture and mitigation. Others are focused on acquisitions, mergers and building new plants during the post-pandemic economic recovery.

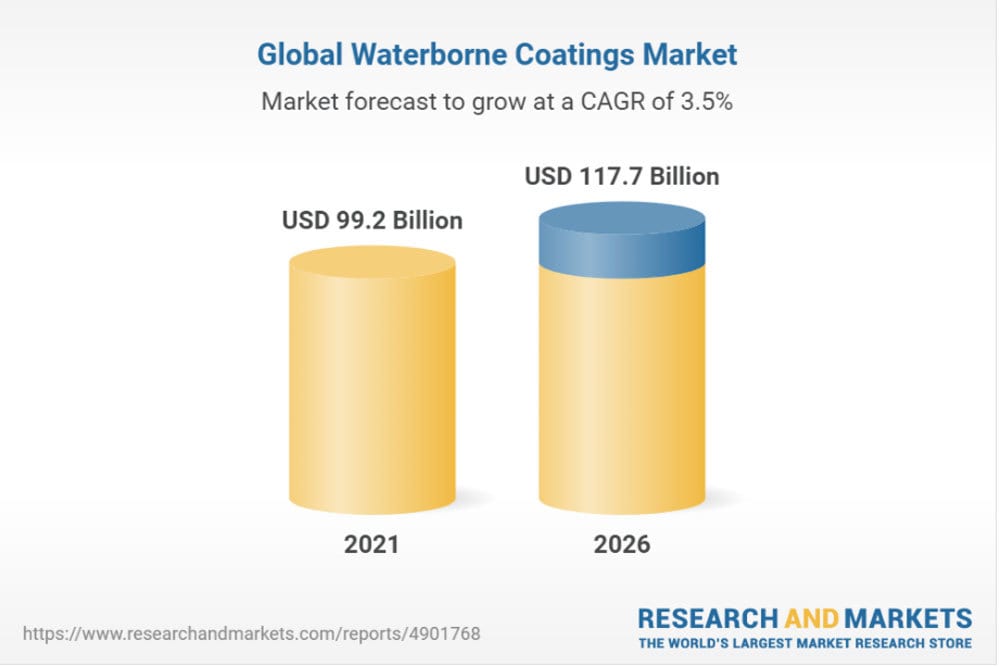

Report Predicts Waterborne Coatings Market to Reach $117 Billion by 2026

DUBLIN – According to a study now available from Research and Markets, the global waterborne coatings market is projected to grow at a compound annual growth rate (CAGR) of 3.5% during the projected period to reach $117.7 billion by 2026. Increasing building and construction activities and infrastructure projects, improving quality of industrial manufacturing in developing countries, and the need for protection of coated products are the major growth drivers of the global waterborne coatings market.

In terms of volume, the study expects the epoxy resin segment to register the highest CAGR of the overall waterborne coatings market during the forecast period. Waterborne epoxy coatings were commercially introduced as an environment-friendly replacement for solventborne products. Earlier, demand for epoxy resins was restricted to developed countries that had stringent environmental and worker safety regulations. Demand has now also increased in emerging countries such as China, India and Brazil, where safety regulations are less stringent. Growth in demand for epoxy resins in waterborne coatings is mainly driven by the need to reduce the emission of organic solvents. This led to the rapid growth of the technology in the concrete protection market and also in OEM applications.

There has also been an increase in the demand for epoxy resins within the coatings industry due to increasing demand from dairies, pharmaceutical companies, food processing units, electronics, aircraft hangars and automotive facilities. The market for waterborne epoxy coatings is expected to witness high growth in countries such as Brazil, Thailand and India due to the increased demand for automotive and other industrial goods.

The residential sub-segment within the architectural application segment is projected to register the highest CAGR during the forecast period. That sub-segment is projected to grow at a higher rate during the forecast period. Growth is expected to be driven by construction activities in Asia-Pacific, the Middle East and Africa. The construction industry is expected to grow in the Asia-Pacific region due to increasing construction projects in Thailand, Malaysia, Singapore and South Korea, which are driving the demand for architectural waterborne coatings.

The waterborne coatings market in Europe is projected to register the second-largest market share during the forecast period. Increasing demand from key industries, such as automotive, aerospace, general industrial, coil and rail, is driving the European market. Rising car ownership, advancements in road infrastructure, and an improving economy and lifestyle are some of the major factors driving the automotive industry in the region. Increases in building construction activity, rising demand from the industrial and oil and gas applications, and the rising motor vehicle ownership are all expected to boost the demand for waterborne coatings during the forecast period.

The report, Global Waterborne Coatings Market by Resin Type (Acrylic, Polyester, Alkyd, Epoxy, Polyurethane, PTFE, PVDF, PVDC), Application (Architectural, Industrial), and Region (APAC, North America, Europe, MEA, South America) — Forecast to 2026, provides detailed segmentation of the waterborne coatings market based on resin type, application and region. Based on resin type, the waterborne coatings industry is segmented into acrylic, polyester, alkyd, epoxy, polyurethane, PTFE, PVDF and PVDC. Based on application, the market is segmented into architectural and industrial coatings. Based on region, the market is segmented into Asia-Pacific, Europe, North America, South America, and the Middle East and Africa.

Image courtesy of Research and Markets.

BCF Unveils Trace VOC Globe to Identify Extremely Low-VOC Paints

MANCHESTER, UK – As of May 2022, decorative paint manufacturers in the U.K. will be able to adopt the use of the statement “TRACE” VOC as part of the British Coatings Federation’s (BCF) VOC Globe scheme to improve communication to consumers regarding products with the lowest levels of VOCs. The TRACE Globe will be used for products with VOC content of less than 0.1%.

Decorative paint manufacturers have significantly reduced the presence of VOCs in their products over the last two decades, with 84% of decorative paints now sold on the market being water-based, and therefore low or very low VOC.

The VOC Globe scheme is part of a wider initiative by the coatings industry to raise consumer awareness of the amount of VOCs contained in decorative paint products, allowing consumers to make more informed, and hopefully greener choices. Greater involvement from paint manufacturers in the scheme will also help paint recyclers separate solvent-based and water-based leftover paint with ease, which aids reuse and recycling.

The BCF takes the position that the use of the terms “zero VOC” and “VOC free” are false claims and should not be used in the paint industry. There will always be a trace element of VOCs, even if no raw materials containing VOCs have been added. Even water can contain trace amounts of VOC. Supply chains for the manufacture of paint are often complex, and VOCs — even at negligible amounts — can also be introduced during any part of the process, through using raw materials that naturally contain VOCs, to processes that introduce VOCs, such as washing raw materials. BCF reports that it is impossible to ensure that every batch of paint is completely free of VOCs because of the potential for trace solvents to be introduced at any point throughout the supply chain.

Image courtesy of the BCF.