INDUSTRY UPDATES

The survey found that two thirds of companies fear losing EU export customers due to the additional cost and complexity of doing business. Seven out of 10 say their opportunities to trade with the EU will decrease. Only 10% see opportunities from new trade deals with the rest of the world. On a more positive note, a quarter of companies thought the FTA might mean more chances to increase trade within the UK.

BCF members also fear the new trading relationship will have a significant impact on UK manufacturing of paints, coatings and printing inks. Of the respondents, 82% have UK manufacturing, 35% were UK SMEs and 60% were foreign-owned businesses.

Key findings of the survey include: 50% believe the new FTA will reduce the competitiveness of their UK factories compared to EU competitors; 25% were concerned there was a risk their company would reduce UK production and move it to the EU; three quarters of those same companies (18.5% of total respondents) believed there was a risk their company could stop operations in the UK altogether; seven out of 10 believe the UK diverging from EU REACH in the future will reduce their competitiveness; and almost 60% are worried about future effects of UK REACH on raw material prices and potential lack of availability of chemical substances.

Commenting on the survey results, Tom Bowtell, CEO of the BCF, said, “BCF members have been encountering serious practical issues since 1st January. The survey results demonstrate the extent of the difficulties our members are having to deal with at the moment and also helps quantify the likely future impact of these changes on the industry.

“While some of the reported delays and disruptions at the borders will hopefully prove to be teething problems, it is clear that added complexity of customs procedures and associated costs are here to stay. There is also a worry that medium-term issues — likely to be posed by the new UK chemicals regulations regimes, like UK REACH — will only exacerbate the situation.

“We therefore need the UK Government to act in two ways. Firstly, it needs to do more to support all businesses coming to terms with the new customs and borders procedures. More resources are needed to iron out problems with IT systems and other processes, as well as to communicate what is needed to both UK and EU companies, through training and marketing campaigns. Secondly, it needs to amend the UK REACH legislation to further mitigate against some of the extra costs and impacts on raw material availability that will inevitably arise based on its current plans. Failure to do so will lead to our members — and other businesses in similar sectors — reaching the higher end of their additional cost estimates and, ultimately, see many reducing or relocating manufacturing in the UK as we become a less competitive country to do business in.”

COVENTRY, UK – A recent survey of British Coatings Federation (BCF) members demonstrates how Brexit has negatively impacted the coatings sector in the form of new customs red tape and higher costs since Jan. 1. The survey reported higher shipping costs, increased costs of imported raw materials, and new administration costs to complete customs paperwork, with 30% of companies estimating increases in total operating costs of 3-10%.

As a result, there are significant risks to the competitiveness of BCF members’ UK production and exports, despite the industry investing in preparing for Brexit (86% of members) and being experienced exporters beyond the EU (75% of companies). The survey indicates that the new Free Trade Agreement (FTA) will have a significant negative impact on UK exports of paints, coatings and printing inks.

BCF Survey Reports Challenges to UK Coatings Industry

Tom Bowtell, CEO of the British Coatings Federation. (Photo courtesy of the BCF.)

The study reports that the market for paints and coatings has been on the increase in various applications, and this has boosted the total market in many regions. Additionally, the market for solventborne paints and coatings is not going down as anticipated, and this has added to the increase in the total market value.

Research and Markets reports that growth is the highest in the powder coatings and emerging technology segment, as new technologies are being developed by major manufacturers with ever-increasing pressure from regulatory authorities in regard to pollution control and other environmental factors. Powder coating technology is being adapted in a big way in all fields of application. The market for coatings manufactured with solventborne technologies is slowly diminishing and being taken over by waterborne technologies, due to their environmentally friendly properties. The report finds that this transition away from solventborne coatings is occurring in the North American and European markets, whereas solventborne coatings are still being widely used in developing countries because of cost factors. High-solids and radiation-cured technologies are experiencing reasonably good growth, as these technologies are considered to be less polluting than solventborne technology. The publisher's market forecasts for solventborne coatings have been reduced somewhat from those in the prior version of this report, based on these ongoing changes in the market.

Research Firm Finds Shift in Global Production of Coatings

DUBLIN – According to a report released by Research and Markets, Global Markets and Advanced Technologies for Paints and Coatings, there is a major shift in the production of global paints and coatings, which is moving away from developed regions, such as Europe and the United States, to developing economies, such as China and India. Continued increasing demand from developed countries, in addition to the demand from developing countries, is contributing to the overall expansion of the worldwide coatings market. Industrial growth in developing economies is a major driver for growth in the coatings industry, according to the study. In most regions of the world, the coatings industry is mature, and the growth of the industry is dependent on a number of factors, including the level of economic activity and the state of the construction industry, which remains a major consumer of paints and coatings.

Photo credit: DingaLT / iStock / Getty Images Plus via Getty images

Peacock Feathers Inspire Possible Innovation in Anti-Counterfeit Coatings

TSUKUBA, Japan – Melanin-like compounds can be precisely designed and arranged to color materials using a mechanism similar to that found in a peacock's feathers. Chemist Michinari Kohri of Chiba University in Japan reviewed the latest research on these “melanin-mimetic materials” and their potential applications for the journal Science and Technology of Advanced Materials.

Melanin and melanin-like compounds absorb some of the light that is scattered from the microstructures within materials. Scientists are finding ways to control this phenomenon to give a variety of iridescent and non-iridescent colors. Melanin is a dark pigment that gives color to hair and skin. It is also essential for the bright colors we see in some organisms. When light interacts with the structures of feathers, wings and shells of many organisms, like peacocks, butterflies and jewel beetles, it is scattered, appearing white. But when melanin is interspersed within these structures, some of the scattered light is absorbed, producing various colors. Scientists are looking for ways to mimic these so-called “structural color” changes of living organisms in synthetic materials.

“Vivid structural colors can be obtained by constructing microstructures containing a light-absorbing black material made of natural or artificial melanin,” said Kohri. “Research in this area is progressing rapidly worldwide.”

A leading contender is a compound called polydopamine. It is made of a material naturally found in the body, so it is biocompatible. It is also dark, so it absorbs light like melanin. Scientists found they could control polydopamine's iridescence — how much the color changes as the angle of light hitting it shifts, similar to a peacock's feather. They achieved this by altering the particle size or by adding compounds that react to a magnetic field.

Scientists are also investigating particles formed of a polystyrene core and a polydopamine shell. Changing the diameter of the inner core, for example, leads to different colors. Making the polydopamine shell thicker causes the particles to be less closely packed, leading to non-iridescent structural color, which remains the same regardless of the light angle. Scientists have also toyed with controlling color and angle dependence by changing the shapes of polystyrene/polydopamine particles, making them hollow on the inside, and adding multiple coatings to the external shell.

Polydopamine particles are showing potential for a variety of applications. For example, they can be used as inks to dye fabrics or in cosmetics. They could help prove a product is real versus counterfeit by shifting color with strong light, wetting or temperature changes. Finally, scientists have found that adding these particles to rubber causes it to change color when stretched or relaxed, which could be useful for sensing local stress and strain in bridges.

Scientists are developing materials inspired by the structural colors in a peacock's feathers. (Photo credit: Takashi Tsujino.)

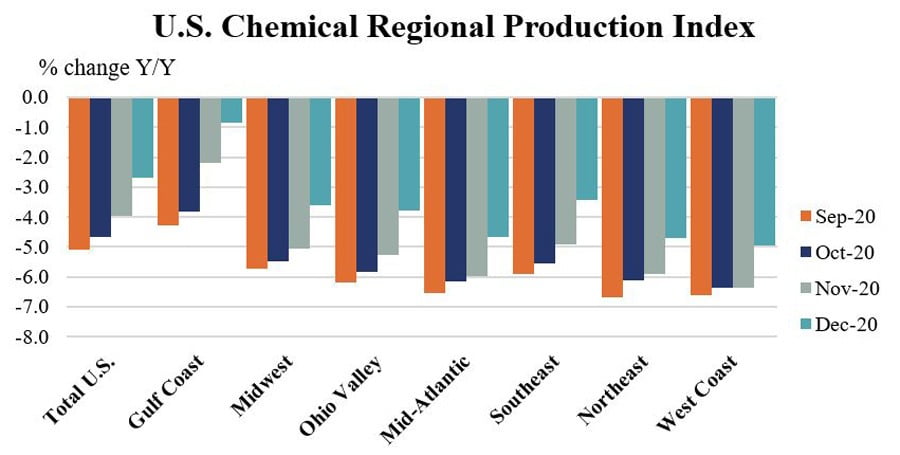

ACC Reports 2020 Chemical Production in U.S. Ended on a High Note

WASHINGTON – The U.S. Chemical Production Regional Index (U.S. CPRI) rose 1.2% in December following a 0.6% gain in November and a 1.2% increase in October, according to the American Chemistry Council (ACC). During December, chemical output grew in all regions, with the largest gains occurring in the Gulf Coast and Midwest regions. Chemical production expanded in all segments except miscellaneous other inorganic chemicals. The U.S. CPRI is measured on a three-month moving average (3MMA) basis.

As nearly all manufactured goods are produced using chemistry in some form, manufacturing activity is an important indicator for chemical demand. The manufacturing recovery continued for a sixth straight month in December, with overall factory activity up 1.1% (3MMA). The trend in production rose in nearly all key chemistry end-use industries, with the strongest gains seen in iron and steel, appliances, aerospace, construction supplies, foundries, plastic products, tires, paper, structural panels, and apparel.

Compared with December 2019, U.S. chemical production was off 2.7%, the nineteenth consecutive month of year-over-year declines but reflecting improvement versus earlier in the year. Chemical production remained lower than a year ago in all regions, with the largest year-ago declines seen in the Northeast, Mid-Atlantic and West Coast regions.

The chemistry industry is one of the largest industries in the United States, a $565 billion enterprise. The manufacturing sector is the largest consumer of chemical products, and 96% of manufactured goods are directly touched by chemistry. The U.S. CPRI was developed to track chemical production activity in seven regions of the United States. The U.S. CPRI is based on information from the Federal Reserve and includes monthly revisions as published by the Federal Reserve. To smooth month-to-month fluctuations, the U.S. CPRI is measured using a three-month moving average. The reading in December reflects production activity during October, November and December.

Chart courtesy of the American Chemistry Council.

SCAQMD Announces New UV/EB BACT Listings

CHEVY CHASE, MD – The South Coast Air Quality Management District (SCAQMD) of Southern California has announced new UV/EB technology listings for its Best Available Control Technology Guidelines (BACT). BACT is a pollution control standard mandated by the Clean Air Act that applies to any new or modified source.

In 2017, the board unanimously supported a motion by Governor appointee Joe Lyou to adopt the following resolution language: “BE IT FURTHER RESOLVED that the Board directs AQMD staff to work with industry and other stakeholders on assessing Ultraviolet/ Electron Beam (UV/EB) technology as an alternative to meet Best Available Control Technology.”

The board’s resolution catalyzed the BACT update efforts, and several UV/EB processes were included last year, including for a wood coatings operation (cabinets) and also for a flat line glass coating operation. The latter is especially significant as the first BACT for glass coatings, making this a groundbreaking listing.

SCAQMD staff recently visited the UV/EB facilities, which reported being extremely happy with the technology. In addition, there is a stringent cost effectiveness for these listings, pointing to the financial benefits of UV/EB.

These BACT decisions do not preclude other processes such as waterborne operations or solvent operations with add-on controls (afterburners) but rather recognizes UV/EB can be viable complaint option. The proposal was finalized on Feb. 8, 2021, when the SCAQMD Board unanimously approved the new BACT listings for UV/EB technology.

The SCAQMD is working to update its BACT listings, with encouragement from RadTech, to better reflect the fast-growing pace of UV/EB technology. Rita Loof, RadTech’s Director of Environmental Affairs, testified at SCAQMD committee hearings, pointing out that other California air districts such as Bay Area and San Joaquin have updated their guidelines, which included super-compliant materials and specifically UV coatings as alternatives to add-on controls. “Our technology is a pollution prevention technology and should be recognized as an alternative to add-on control devices in the guidelines,” said Loof at a meeting of the District’s Board. Several SCAQMD Board members expressed support for UV/EB technology, indicating they believed it is “very clean.”

Photo credit: bjdlzx / E+ via Getty images