Ready to proof — CLJ 2/8/22

KJ proofed on 2/9 and sent corrections

Revised on 1/10

Ready for author

TARGET THE MARKET

A regular column featuring excerpts from BCC Research reports on industry sectors involving the paint and coatings industry.

Global Market for

Anti-Corrosion Coatings

Video: Fritz Jorgensen, Creatas Video+/Getty Images Plus, via Getty Images

By BCC Research, edited by Dr. Helia Jalili, Industry Director, Advanced Materials, Wellesley, MA

The anti-corrosion coatings market is estimated to reach $32.5 billion by 2024 at a compound annual growth rate (CAGR) of 4.0%.

Corrosion is a natural, although unwanted, process. During this process a material, most often a metal, reacts with the environment, particularly humidity and temperature. This phenomenon has been known for centuries, and we all encounter it in our daily life. From seasoning our cast-iron pans to greasing door hinges and bike chains, we all have experience with homemade anticorrosion coatings. A thin layer of grease prevents the surface of the cast-iron pan to react with moisture and oxygen, and prevents it from rusting (depending on your seasoning skills, of course).

While the idea of coating the surface of parts/tools with a thin layer of material to prevent oxidation sounds like a simple solution, the challenge remains in finding the right material for each job. Good anti-corrosion material for coating must have these properties: It must be cost effective, long-lasting, environmentally friendly, and easy to handle and apply.

Anti-corrosion coatings in industrial settings have been a growing field, owing to the rising needs of end users in construction, automotive, transportation, consumer durables and industrial machinery. The majority of these end-user applications are in turn driven by consumers who contribute to each of these growth engines of the economy. Macroeconomic factors such as consumer confidence, purchase power, investment climate, manufacturing base expansion and trade relations are among the few specific parameters that decide the growth of the anti-corrosion coatings market.

BCC Research published a comprehensive report covering the global market of anti-corrosion coatings, and here we share a few highlights from the report.

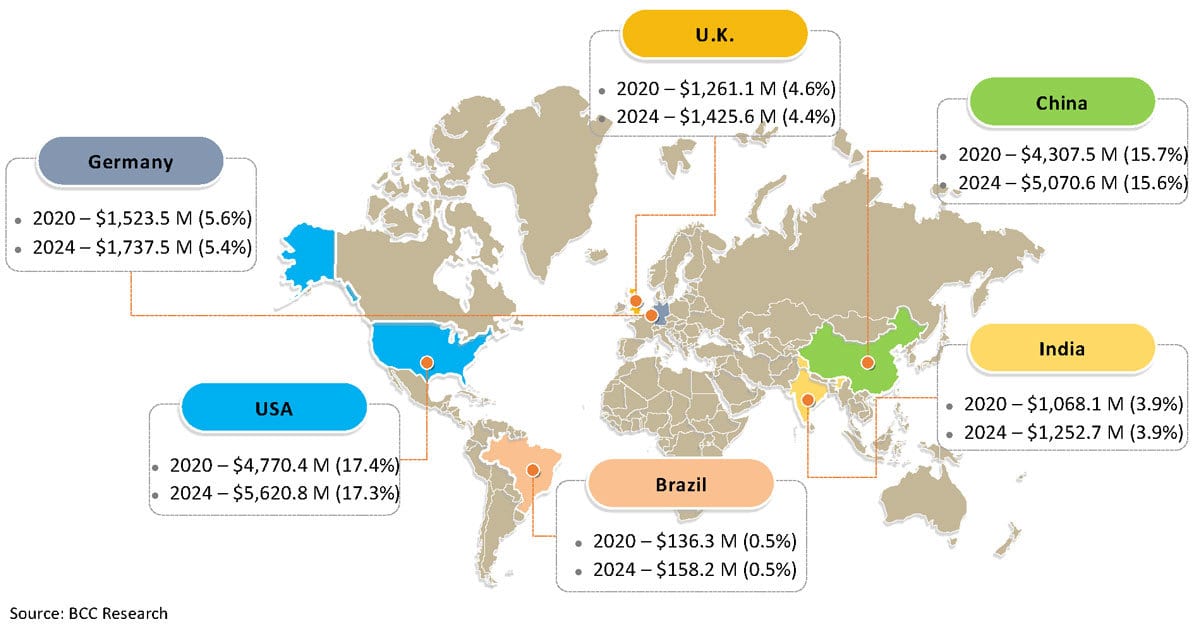

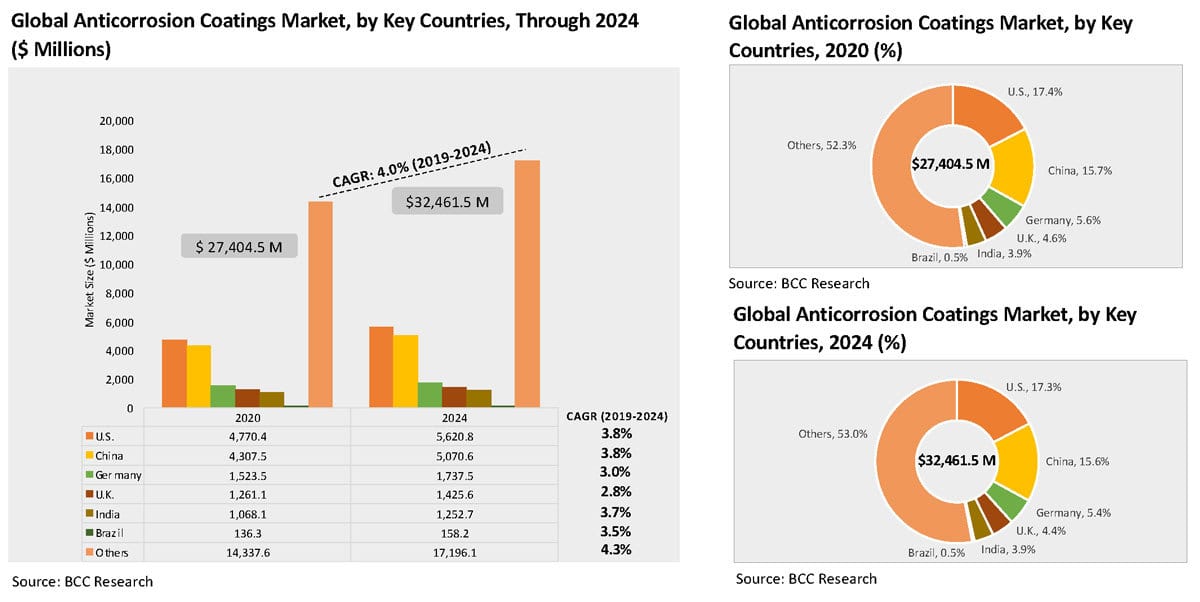

Market Breakdown by Country

During 2019, the top countries highlighted in Figures 1 and 2 below contributed up to 54% of the global anti-corrosion coatings market. Other regionally leading countries include Canada, Mexico, Japan, South Korea, Russia, Italy, Spain and other GCC countries. These countries together are considered the primary movers of the global economy, and the manufacturing output thus remains a core focus for anti-corrosion coatings.

FIGURES 1 and 2 ǀ Global anti-corrosion coatings market by country through 2024 (by $ millions and %).

Asia is expected to remain a prominent consumer of coatings and is expected to observe the fastest growth in the coming years due to the prowess of its manufacturing base. In addition, the increasing competitiveness of regional end-user demand fueled by government initiatives to secure the local economy is expected to drive countries’ specific industrial output over the forecast period.

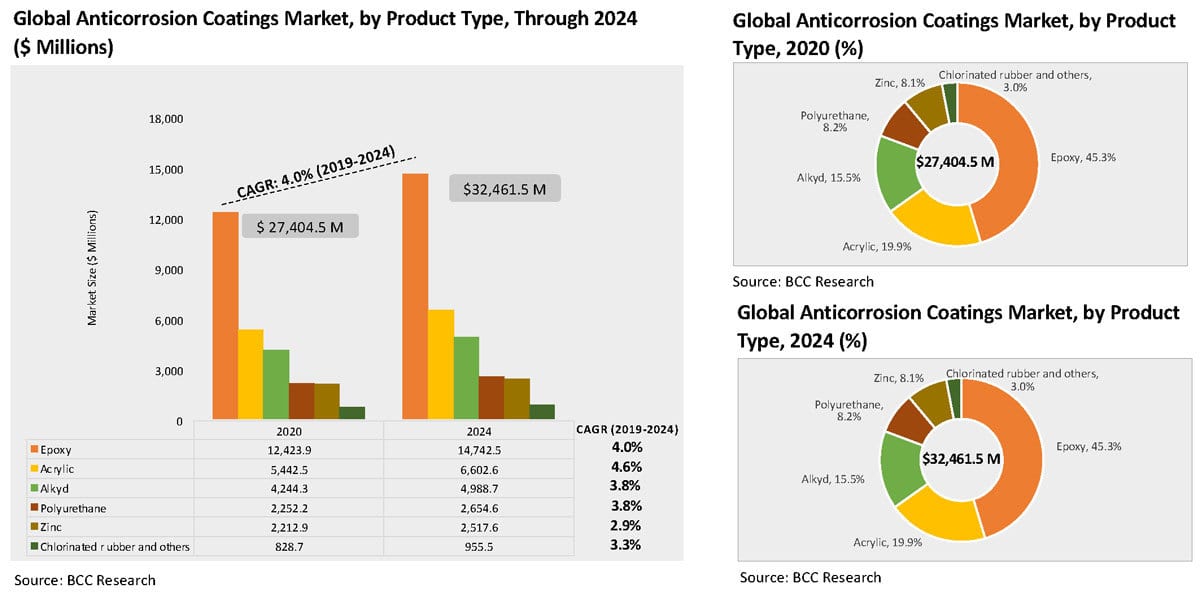

Market Breakdown by Product Type

Growing environmental concerns, along with enforcement of regulatory requirements at the governmental levels, remain the driving factors for suppliers of anti-corrosion coatings to constantly innovate. The guidelines provided by various regulatory bodies applicable to coatings manufacturers are stringent due to the carcinogenic and flammable properties of solvents. Therefore, powder and water-based coatings are expected to gain popularity over the forecast period owing to their large-scale availability, environment-friendly nature, and low volatile organic compound (VOC) properties.

Epoxy and acrylic coating types are expected to be the fastest-growing segments within anti-corrosion coatings. This is due to their being found in a wide range of applications driven by ease of use and product functionality effectiveness. With the anticipated demand driven by the manufacturing sector-focused investment, usage of these anti-corrosion coatings is expected to increase during the forecast period (Figure 3).

FIGURE 3 ǀ Global anti-corrosion coatings market by product type through 2024, (in $ millions and %).

Several governments have introduced strict regulations related to wastewater emissions for municipal and industrial sectors. Key governmental authorities such as the U.S. Environmental Protection Agency (EPA) and European Environment Agency (EEA) are playing important roles in improving the quality of water environments and preventing water pollution. These regulatory efforts are expected to drive the wastewater treatment equipment-related investments over the forecast period and in turn expected to drive demand for coatings.

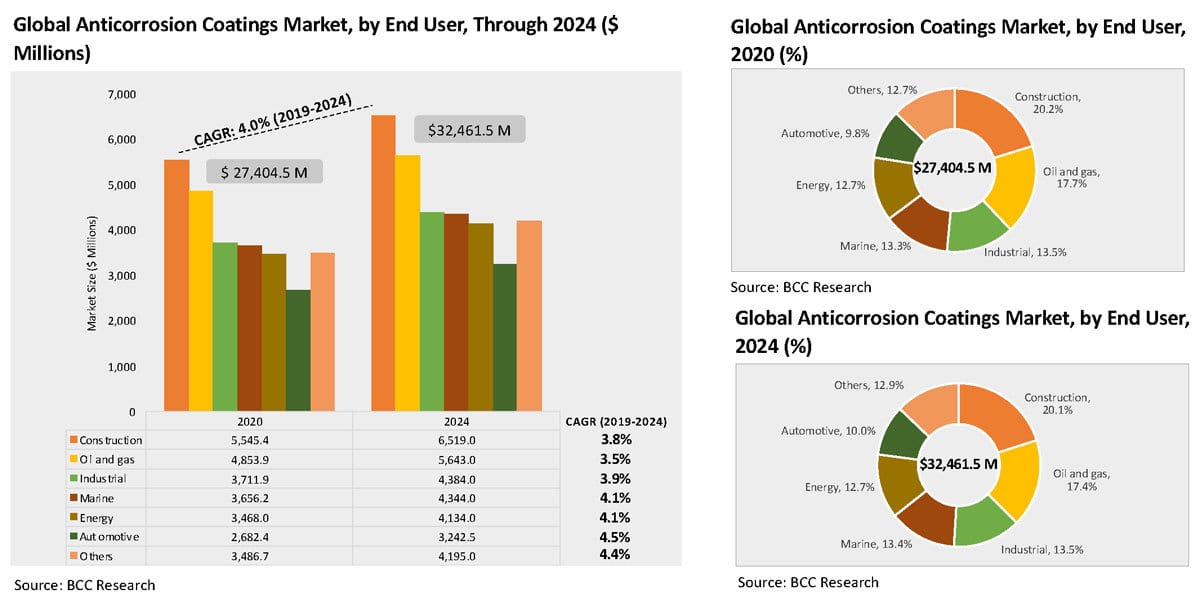

Market Breakdown by End User

The architectural application segment is expected to have high penetration due to increasing construction and infrastructure activities in Asia-Pacific and the Middle East. An increasing application scope in the architectural industry such as for interior and exterior walls, doors, trim and facades is expected to further drive the market. Increasing demand for maintenance work, and special primers for concrete and metal structures are expected to drive demand for high-performance coatings.

The automotive application segment is expected to grow at the highest CAGR of 4.5% over the forecast period. An increasing middle-class income level, coupled with rising living standards in the emerging economies of Asia-Pacific, and Central and South America, are projected to fuel automotive sales. The low cost of production of waterborne coatings, coupled with the long shelf life of powder coatings, is expected to drive the demand. On the other hand, automotive refinishes are expected to exhibit high growth and penetration over the forecast period. Government regulations on the VOC content for automotive refinish coatings in Europe and North America are widely accepted, as the manufacturers are specifying them for repair work on all sold vehicles.

Metal packaging or metal coil coat is one of the application segments within the “others” category expected to witness considerable growth and penetration over the forecast period. Increasing demand for beverage cans and food cans in the food and beverage industry is expected to drive the waterborne anti-corrosion coatings market. Rising content specifications in the food and beverage industry are further expected to boost the demand over the forecast period (Figure 4).

FIGURE 4 ǀ Global anti-corrosion coatings market by end user through 2024 (by $ millions and %).

Over the last decade, the anti-corrosion coatings market has undergone a major shift in terms of manufacturers’ strategic priorities, leading to merger and acquisition (M&A) activities resulting in a reasonable consolidation trend considering long-term goals. As part of this shift, small and medium companies have gained international exposure by leveraging parent companies’ brand images and have grown significantly, along with market expectations.

The lockdown imposed did not yield the anticipated result with an immediate effect as expected, and it is pertinent to say that the consequences associated were more to do with a short slump in the economy. While most of the economies have been predicted to contract for Y2020, the revival state of economies remains uncertain until late 2021. While the health and hygiene sector is experiencing an all-time rise, funding for future projects remains uncertain, since facilitation from the private-sector-controlled manufacturing industries has slowed down due to macro-factors such as the impact of the Coronavirus, the U.S.-China trade war and other geopolitical events.

All Paint & Coatings Industry Magazine readers are entitled to a 20% discount on the purchase of a BCC research report. Simply provide a link to this article with your order, and the 20% discount will be applied to the final invoice. Visit BCC Research: Market Research Reports & Industry Analysis for a comprehensive listing of over 20,000 available and planned reports that will help you make informed business decisions. For more information, please contact Dr. Helia Jalili at helia.jalili@bccresearch.com.