Ready to proof -- Clare 4/12/23

CB proofed 4/12/23

KJ proofed on 4/13. Ready for author

TiO₂ INSIDER

By Gerald Colamarino, Director, TiPMC Solutions

TiO2 Industry: Painful Results Not Shared Across Value Chain

Video: Xiaoxing Zhao / Creatas Video, via Getty Images

The TiO2 industry has experienced three extremely difficult quarters, as rapid decreases in underlying demand, followed by destocking, led to significant decreases in demand. Multinational producers’ (MNPs) volume in Q4 2022 was 35% lower than Q4 2021. This followed a third quarter that was down 18% compared to the previous year. Although Asia is recovering, mainly as a result of a post-COVID economic stimulus in China, recessionary headwinds throughout Europe and the Americas are significantly impacting demand in 2023.

MNPs continue to seek price stability, dramatically reducing production rates across the world to manage inventories, while Chinese producers have favored lowering price and maximizing volume. Earnings for all producers are depressed, with two MNPs recording Q4 2022 with negative EBITA. Negative earnings are reported on the part of multiple Chinese producers, with high-cost producers reducing operating rates.

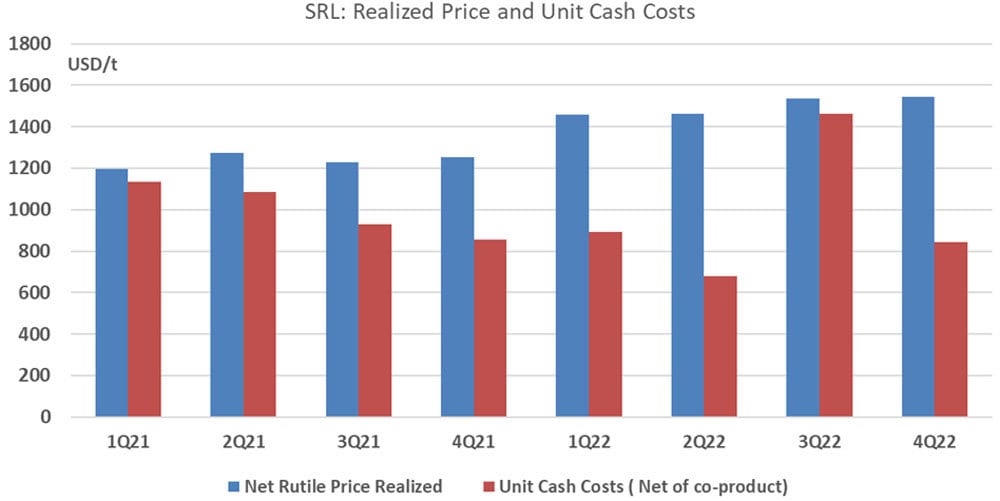

The pain is not being felt by feedstock producers. Major mineral sands producers have reported strong demand for their products, with near-record-high prices for all grades of feedstock. Producers are seeing record pricing and strong demand for zircon, the high-value co-product of titanium mining, providing significant earnings and cash. Mineral sands producers are also monetizing their monazite waste product, as monazite contains high concentrations of rare earth elements, increasing in demand as the magnetic material driving electric motors for EVs.

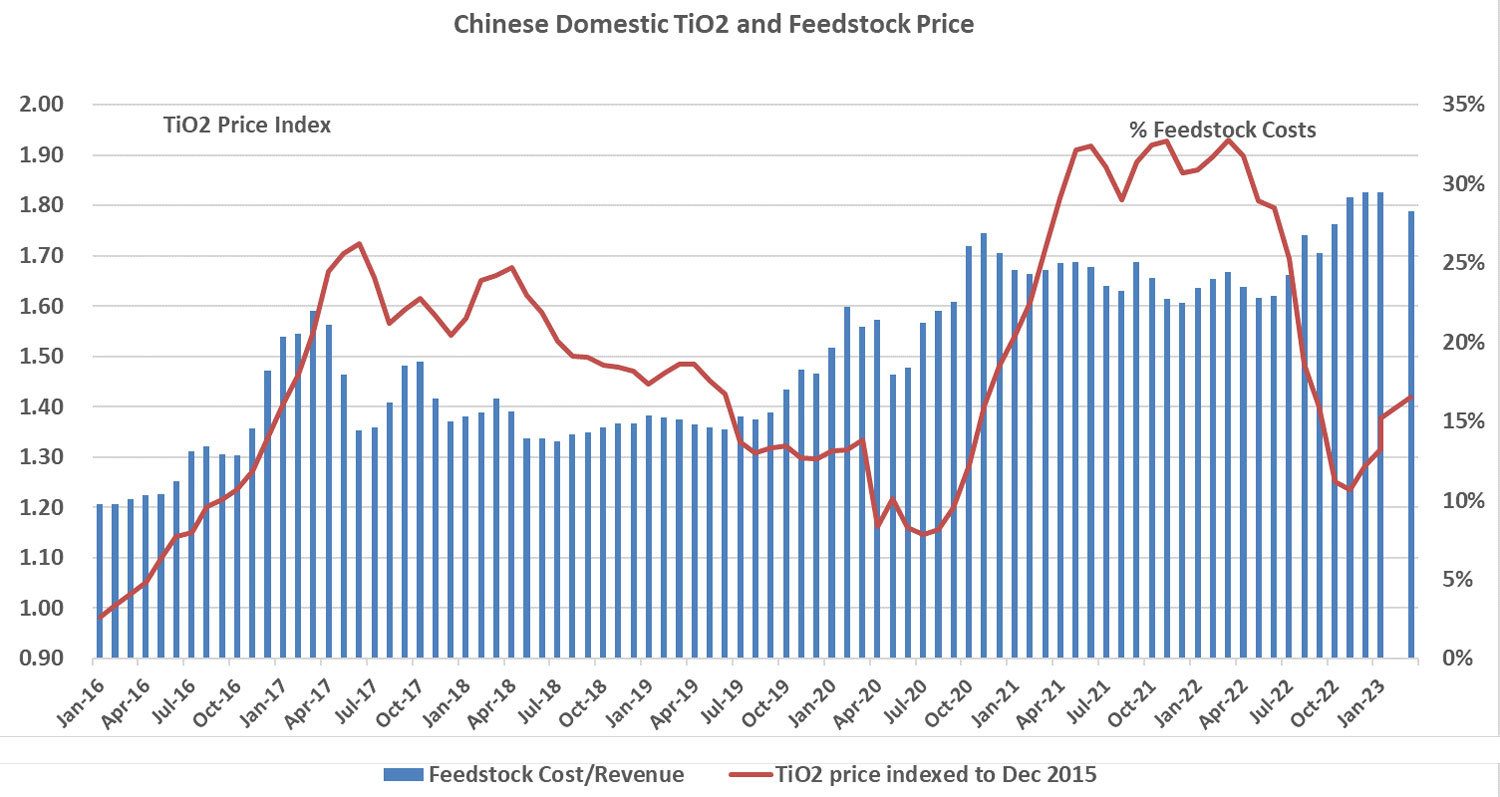

The imbalance is driven by several factors. Mines require reinvestment, both for depleted resources and demand growth. Reinvestment in titanium mining has been scarce, as projects started early last decade struggled with profitability and sustainable cash flow. Project life and valuable heavy mineral content, along with favorable assemblage of those heavy minerals, has made new projects more challenging. Increasingly, mineral sands operations are dealing with high political, social, and cost risk, as witnessed most recently by South African producers. New projects were hampered by COVID restrictions as travel to and from Western Australia, the hub of mineral sands technology and engineering, was heavily restricted. Chinese producers, despite their drive for greater production, are experiencing increasing costs from their domestic and foreign feedstock suppliers. Mineral processing costs in China have skyrocketed. Domestic producers are seeing ever-increasing costs for their primary source of ilmenite, tailings from local iron mines, as demand for Chinese iron ore does not keep up with demand for tailings. Increasingly, Chinese processors are importing unfinished heavy mineral concentrate. Foreign miners can extract heavy mineral at lower initial capital costs, but multiple handling steps and losses result in lost value.

FIGURE 1 ǀ 2016-2022: Chinese TiO2 pricing index and % feedstock costs. Source: Ferroalloynet.

FIGURE 2 ǀ 2021-2022: Sierra rutile realized price and unit cash costs of natural rutile.

Source: Iluka/SRL Demerger Briefing/ Sierra Rutile.

What Does It Mean for TiO2 Consumers, and What Can Be Expected in the Future?

TiPMC believes value within the TiO2 value chain has shifted upstream. Feedstock producers have gained a much greater percentage of the overall earnings pie than at any point over the last three decades. Other key industry suppliers, such as chlorine producers, are following. The years of value-chain compression have impacted upstream supply. The management and investors in these upstream companies have responded appropriately to restore value in the basis of the TiO2 value chain.

TiO2 companies will need to maintain and grow their portion of the value chain. TiPMC believes an increasing portion of the capital investment within TiO2 will focus on cost reduction. High-quality products will require a premium price to sustain supply. TiO2 will not sustain wide commodity swings as seen in other industries.

For more insights into the TiO2 and Mineral Sands markets, visit TiPMCconsulting.com.