Ready to proof -- CLJ 08/04/21

KJ sent corrections on 8/10

revised 8/12

revised 8/13

ready for author

Photo: Ran Kyu Park, iStock/Getty Images Plus, via Getty Images

Who Scores on Top?

The J.D. Power 2021 Paint Satisfaction StudySM

By Kristin Johansson, Editor-in-Chief, Paint & Coatings Industry Magazine

In late spring of this year, J.D. Power released its 2021 Paint Satisfaction Study. The study examines key drivers of satisfaction among customers who purchased and applied interior paint, exterior paint and/or exterior stain. I reached out to Christina Cooley, Director of the Home Intelligence Practice at J.D. Power, to gain some deeper insights into the report.

PCI: How many people did you survey for this study?

Cooley: The 2021 Paint Satisfaction Study is based on responses from 5,804 customers who purchased and applied interior paint, exterior paint and/or exterior stain in the past 12 months.

PCI: What key drivers of satisfaction did you evaluate among paint buyers?

Cooley: Paint and stain satisfaction are driven by application, durability, offerings and price. For the paint purchase experience at a retailer, the key drivers of satisfaction are staff and service, store experience, merchandise, price, and online experience.

PCI: What other areas of the customer experience do you examine in the survey?

Cooley: In addition to the customers' satisfaction with the paint/stain and retail experience, the survey also explores brand awareness, consideration and past brand experience. The survey seeks to understand what triggered the customer to shop for and purchase paint, the steps they took in shopping for paint/stain, the research they did online while shopping, what they experienced on their first retail visit, the materials they used to make their color selection, the number of gallons purchased, whether they purchased in store or online, why they selected the brand they picked, whether their purchase was driven by paint brand or by the retailer they shopped at, and who the primary decision maker was in starting the project/selecting the brand/selecting the color. The survey also captures loyalty metrics, future home improvement intentions and demographics for the study respondents.

PCI: What are the main segments included in the study, and how are they broken down?

Cooley: The study includes four segments/awards: Interior Paint, Exterior Paint, Exterior Stain and Paint Retailers. We identify customers who have purchased and applied paint/stain in the last year, then what product was purchased, and then what brand was purchased. Our study is focused on the largest brands in each of these segments, covering at least two thirds of the market share. In the survey we identify the retailer purchased at, and the respondent completes an additional question set on the retailer experience when purchasing through one of the largest paint retailers.

PCI: What do the results of the study say about architectural paint purchases during the pandemic — both on the behalf of the customers and the retailers?

Cooley: Even in the pandemic, paint shoppers headed to stores, seizing the opportunity of extra time at home to take care of home improvement projects around the house. More than half of respondents participating in this study are either working on a home improvement project or are considering or planning for one. Paint shoppers are more likely to head to their preferred retailer than shop based on brand, which creates a separate challenge for both the retailer and the paint brand.

Retailers can best differentiate themselves through their staff and the experience they provide to their customers, while brands have to build awareness further up the shopping/purchase funnel through their digital presence, marketing and creation of brand advocates. Almost half of paint shoppers went to a store to research paint.

Interestingly, only about one-fifth of interior paint shoppers research online, which is a lower rate than exterior paint or exterior stain shoppers. Interior paint customers are looking for a more consultative experience when making their purchase, which explains their preference for in-store vs. online shopping. Surprisingly, even in the pandemic, online purchases aren’t increasing for interior paint, though they continue to rise for exterior paint and stain. For those researching paint online, they are typically spending about 2.5 hours in doing so. Generation X is spending the most time researching online for interior paint. For exterior paint and stain, generations Z and Y spend more time researching online. In terms of overall satisfaction, exterior paint and exterior stain customers report a fairly consistent level of satisfaction, regardless of whether their purchase was made online or at the store. However, for interior paint, satisfaction is lower among those purchasing in store. Since the vast majority of purchases are made in-store, the data indicates there continues to be an opportunity to better meet the needs of interior paint shoppers. It is not just about buying paint, but rather receiving the education, guidance and support to give the purchaser confidence that they will be successful with their project.

PCI: How did the major paint manufacturers rank in the study?

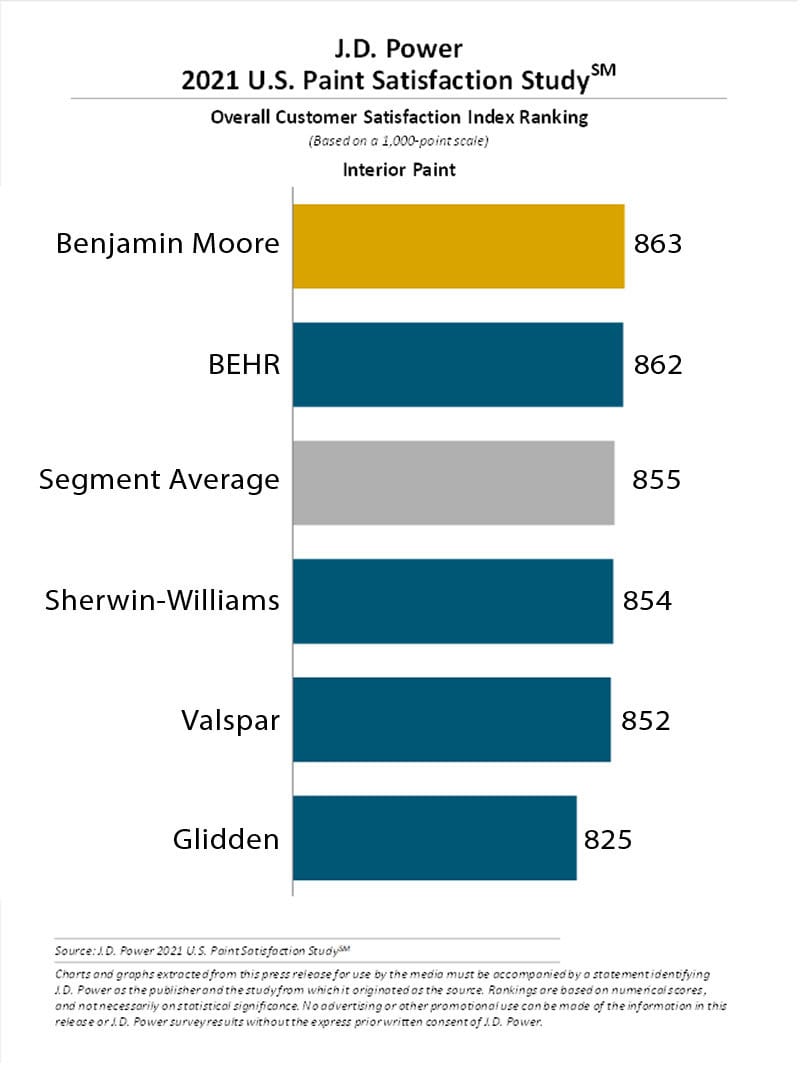

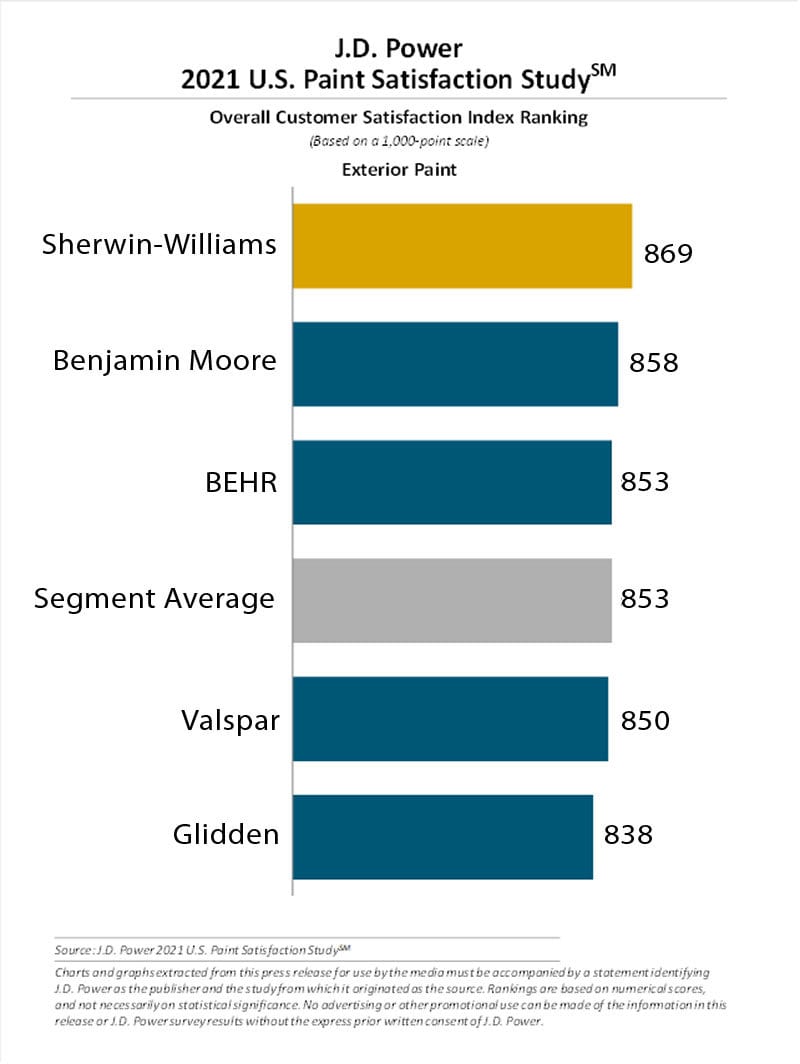

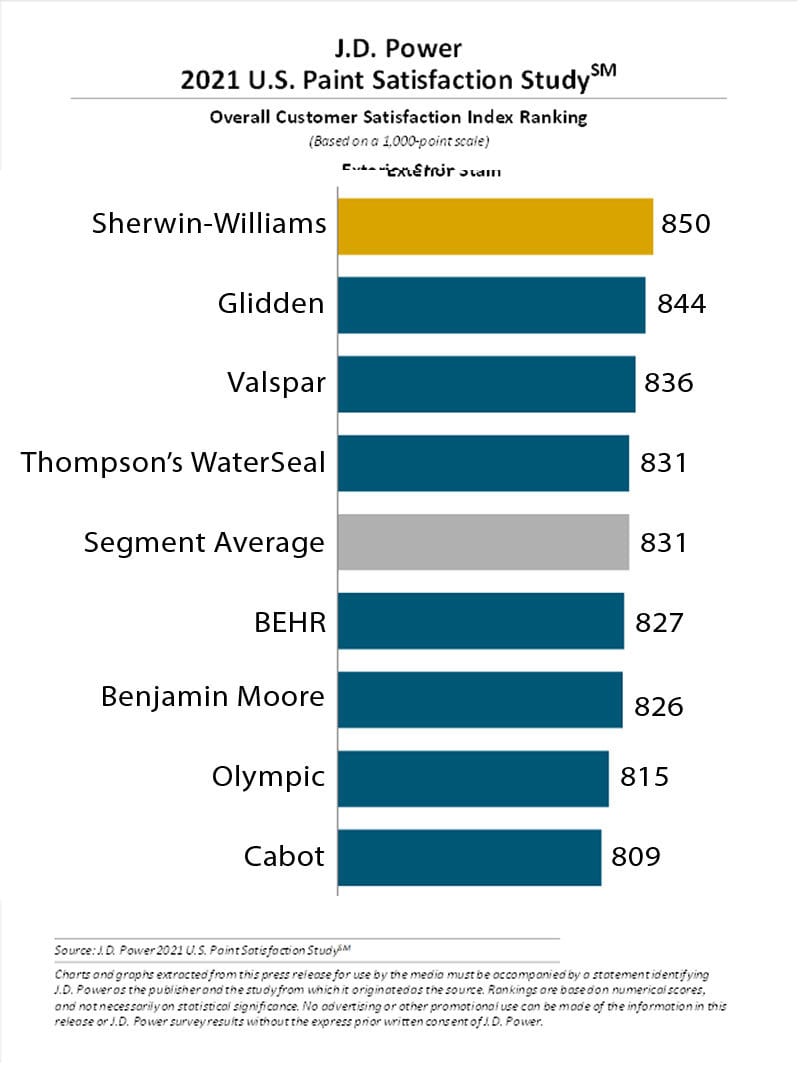

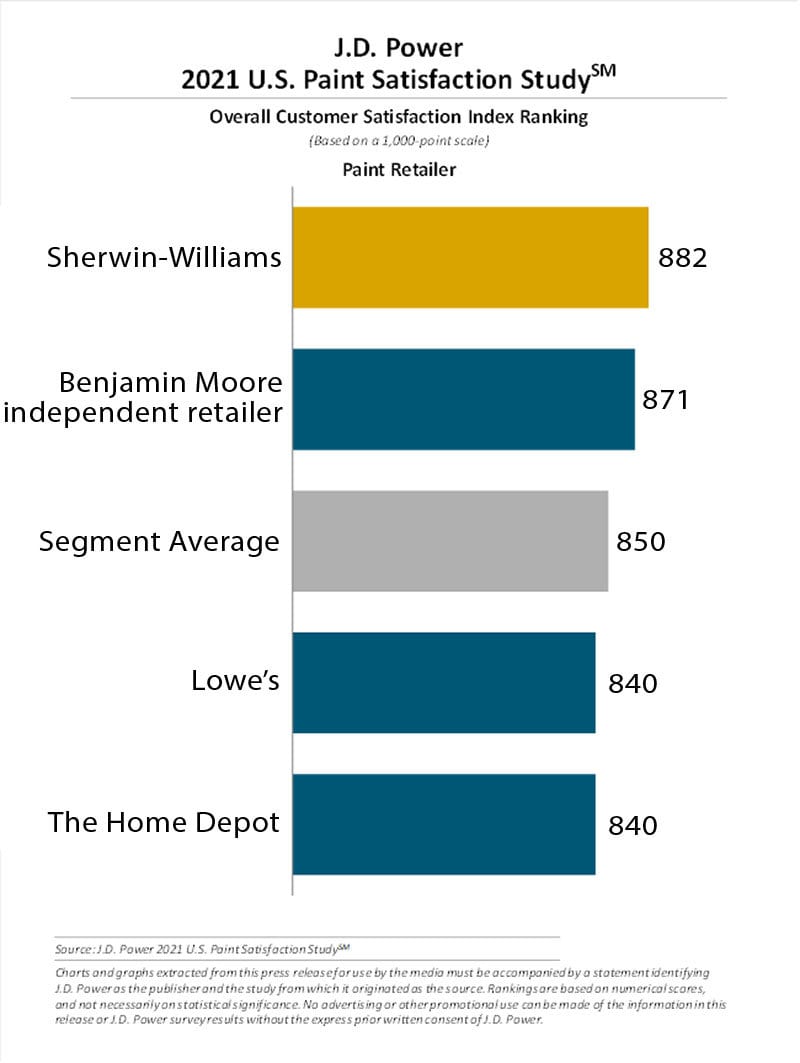

Cooley: Benjamin Moore ranks highest in the interior paint segment with a score of 863 (based on a 1,000-pooint scale). BEHR ranks second, with a score of 862 (Figure 1). Sherwin-Williams ranks highest in the exterior paint segment with a score of 869. Benjamin Moore ranks second, with a score of 858 and BEHR ranks third with 853 (Figure 2). Sherwin-Williams ranks highest in the exterior stain segment with a score of 850. Glidden ranks second with 844 and Valspar ranks third with a score of 836 (Figure 3). And Sherwin-Williams ranks highest in the paint retailer segment with a score of 882. Benjamin Moore independent retailer ranks second with 871 (Figure 4).

FIGURE 1 ǀ Overall customer satisfaction index ranking — interior paint.

FIGURE 2 ǀ Overall customer satisfaction index ranking — exterior paint.

FIGURE 3 ǀ Overall customer satisfaction index ranking — exterior stain.

FIGURE 4 ǀ Overall customer satisfaction index ranking — paint retailer.